International money transfers are an increasingly important aspect of our globalized world. With the rise of remote work and cross-border trade, the ability to easily and securely send and receive money across borders has become a critical need for individuals and businesses alike. In this context, Wise (formerly TransferWise) has become one of the leading players in the market, offering fast, cheap and transparent solutions for international money transfers.

In the following lines, we’ll take a look at what Wise has to offer for international money transfers and assess how well it stacks up against the competition. We look at the key features of the service, including exchange rates, fees, security measures and ease of use.

Content

What is Wise?

Wise is a fintech company founded in 2011 that aims to make international money transfers faster, cheaper and more transparent. The company has grown rapidly over the years and now serves more than 16 million customers in more than 70 countries. Wise offers a wide range of services including international money transfers, borderless accounts and debit cards. The aim of all these services is to make cross-border transactions easier and more accessible.

Wise’s unique peer-to-peer model allows it to bypass the traditional banking system and offer exchange rates up to 8 times cheaper than banks, making it an attractive option for individuals and small businesses looking to transfer money abroad. In addition, the company has earned a reputation as one of the leading players in international money transfers thanks to its easy-to-use online platform and transparent fee structure.

Wise is suitable for a wide range of users, including individuals traveling internationally, small businesses with international customers or suppliers, and freelancers and remote workers who need to send or receive payments from multiple countries.

Low fees and competitive exchange rates make the company an affordable choice for regular money transfers, while a borderless account and debit card allow users to easily manage their money in multiple currencies.

Wise options

Wise offers a number of features that make international money transfers fast, easy and convenient for customers. Here are some of the main features that the company offers:

Types of accounts

Wise allows customers to open two types of accounts: personal accounts and business accounts.

Personal accounts are for individuals who want to send money abroad for personal reasons, such as to friends and relatives, or to pay for goods and services online.

Business accounts are designed for small and medium-sized businesses that need to make regular international payments. There are also options for large companies that need to pay up to 1,000 employees or suppliers located in different countries.

Read also: TOP 10 BIGGEST STOCK MARKET SCAMS

Money transfers

Wise allows customers to easily send money to more than 170 countries around the world. Transfers can be made from either a bank account or debit card, with some local options including Apple Pay, Google Pay, PayPal and more.

Wise provides real-time transfer status updates so customers know exactly when the funds will be available. Customers can choose batch and recurring payments and initiate the same type of payment multiple times to recipients on their list.

Unlimited account

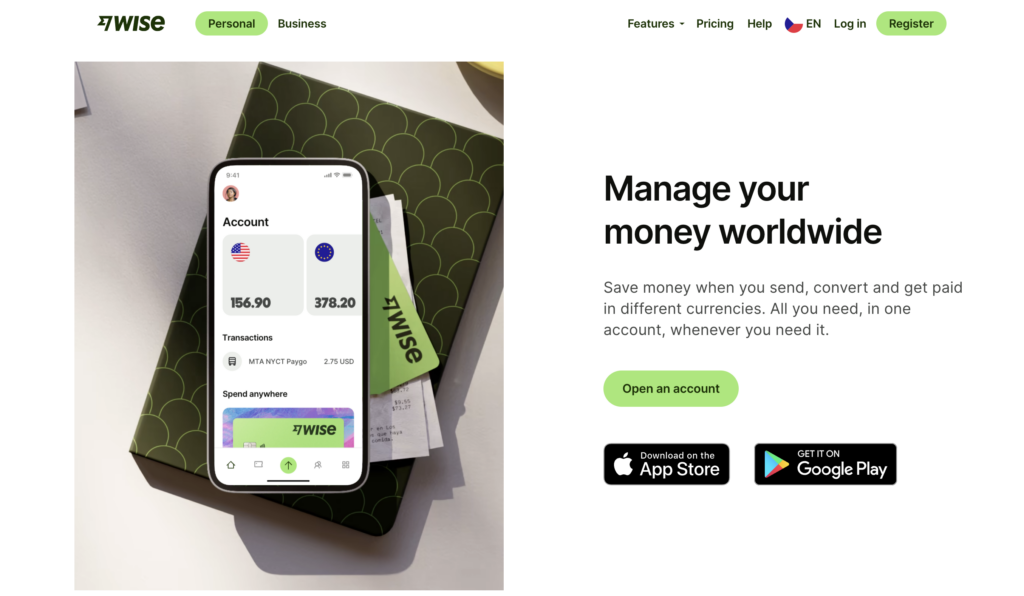

Wise’s unlimited account allows customers to store, send and receive money in multiple currencies without having to pay conversion fees or hidden fees. It is therefore ideal for customers who need to make regular international payments in different currencies.

Wise Debit Card

Wise also offers a debit card that allows customers to spend money abroad without hidden fees and commissions. The debit card can be used wherever Mastercard is accepted and customers can choose the currency in which they deposit their money.

Wise for Teams

Wise for Teams is a feature designed for businesses that allows teams to manage international transfers from a single, centralized account. Businesses can easily track expenses and manage cash flow regardless of where team members are located.

Wise API

Wise also provides an API for businesses to integrate their systems with Wise and automate international payments. This can help businesses increase efficiency and save money.

You might be interested in: Zetano – Regulatated broker review

Transfer fees

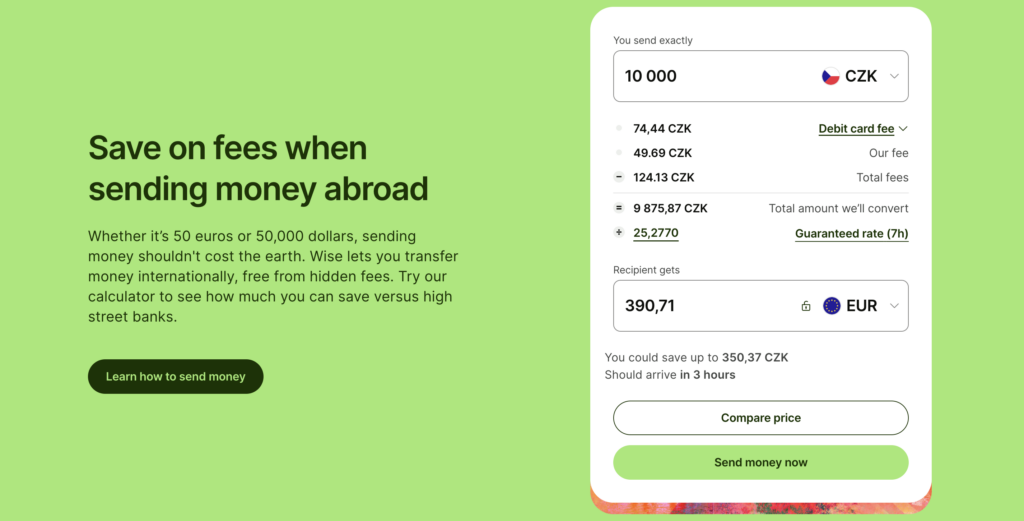

Wise charges a small fee for each transaction, which is clearly stated before the transfer is made. The exact amount of the fee depends on the amount of the transfer and the country the transfer is being sent to, but Wise tries to keep the fee as low as possible to make international transfers affordable for everyone.

Wise sets two types of transfer fees:

Variable fee : a percentage of the total amount transferred. It can vary from 0.35% to 3% depending on the selected currencies and type of payment method (on average 0.4% to 0.6%);

Fixed fee : a small fixed amount regardless of the amount of the transfer. It can vary from £0.2 to £2 depending on the currencies selected and the type of payment method (on average £0.2 to £0.3).

Wise does not charge any additional fees such as hidden fees or conversion fees, which means customers can rest assured that they know exactly how much they will pay for their transfer. There are also no fees for receiving money into your Wise account.

How to use the Wise app

International money transfer with Wise is simple and easy. Here are the steps the customer needs to take:

- Create an account . The first step is to create a Wise account by visiting the Wise website or app and following the registration instructions. You will be required to provide personal information such as name, address and an ID card issued by the relevant authority in order to verify your identity;

- Add funding source . Once you’ve created your account, you’ll need to add a funding source, such as a bank account or debit card, from which you’ll be sending money. Wise will use this information to withdraw funds from your account and initiate the transfer;

- Select the recipient and enter the amount . In the Wise control panel, you can choose the recipient, enter the amount you want to send and select the currencies to which the transfer applies. Wise automatically calculates the exchange rate and displays the conversion fee;

- Check and confirm . You will have the opportunity to review all details and confirm the transaction before completing the transfer. Once the transfer is confirmed, Wise will initiate the transfer and notify you of its status;

- Acceptance of funds . The recipient will receive the funds into their bank account or their Wise account if they have one. Once the transfer is complete, Wise will notify both the sender and recipient.

It is important to note that for some transfers, Wise may require additional information or documents, such as proof of payment for the transaction or identification of the recipient.

Don’t Miss: M4Markets Review

Wise customer service

Wise is known for its excellent customer service, available 24/7 via email and chat. The company has a good reputation for quick and responsive responses to customer queries and comments, with many customers commenting on the efficiency and friendliness of the support staff.

Wise also has an extensive help center that contains detailed FAQs and articles on a variety of topics related to using the service. In addition, the company has many live forums where customers ask questions and get answers from other users as well as Wise employees. As an international company, Wise is available in 15 languages.

Conclusion

In this review, we learned that Wise is a leading player in the international money transfer market. With a high degree of transparency, a strong online trading system and a mobile application, Wise attracts many customers around the world.

Wise provides an online account that allows users to make affordable international payments and receive foreign currency payments into their Wise account. The user experience is considered one of the best in the money transfer industry, and the debit card provided by Wise to all business users is a high-quality asset for overseas spending.