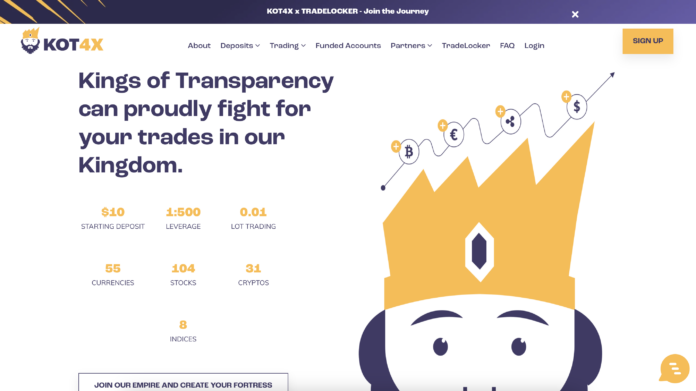

KOT4X is an online forex and cryptocurrency broker founded in 2020 and located in St. Vincent and the Grenadines. It offers a variety of account types with different spreads, commissions, and minimum deposits, and a maximum leverage of up to 1:500. KOT4X is regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines.

Are you a cryptocurrency enthusiast interested in forex trading? KOT4X might have caught your eye with its crypto-friendly platform and multiple account options. But before diving in, a thorough review is essential. This review will take a deep dive into KOT4X, exploring its features, account types, and trading platform. We’ll analyze both the potential benefits and the red flags to consider, like the lack of clear regulation. By the end, you’ll have a clear picture of whether KOT4X is the right forex broker for you.

KOT4X Review – Table of content

Key features of the broker

- A wide range of trading instruments: KOT4X offers forex, cryptocurrency, stock, and index trading.

- Competitive spreads and commissions: KOT4X offers competitive spreads and commissions on its forex and cryptocurrency trading instruments.

- High leverage: KOT4X offers maximum leverage of up to 1:500.

- Multiple account types: KOT4X offers a variety of account types to suit different trading needs.

- A variety of trading platforms: KOT4X offers a variety of trading platforms, including MetaTrader 4, MetaTrader 5, and its own web-based platform.

- Excellent customer support: KOT4X offers 24/5 customer support in multiple languages.

Read also: TOP 10 BIGGEST STOCK MARKET SCAMS

KOT4X – Trading instruments

KOT4X offers an extensive range of trading instruments encompassing forex pairs, cryptocurrencies, stocks, and indices. Let’s delve into each category to gain a comprehensive understanding of their offerings:

Forex Pairs:

KOT4X provides access to over 55 forex pairs, catering to both major and minor currency pairs. Major pairs, such as EUR/USD and USD/JPY, are widely traded and exhibit high liquidity. Minor pairs, on the other hand, involve combinations of lesser-traded currencies and offer unique trading opportunities. KOT4X’s forex selection also includes exotic pairs, which involve combinations of a major currency and an exotic currency from emerging markets.

Cryptocurrencies:

KOT4X embraces the burgeoning cryptocurrency market by offering over 31 digital assets for trading. Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) are among the prominent cryptocurrencies available on their platform. These cryptocurrencies have established themselves as leading players in the decentralized finance (DeFi) landscape and present compelling trading opportunities.

Stocks:

KOT4X expands its reach to traditional equities by providing access to over 104 stocks from major markets worldwide. Traders can gain exposure to blue-chip companies from the United States, Europe, and Asia, including Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). These stocks represent established businesses with proven track records and offer diversification benefits within a portfolio.

Indices:

KOT4X rounds out its instrument offerings by providing eight key indices that reflect the performance of broader markets. The Dow Jones Industrial Average (DJI), S&P 500 (SPX), and FTSE 100 (UKX) are prominent examples, capturing the sentiment of the US, US, and UK stock markets, respectively. These indices provide a convenient way to gauge overall market trends and gain diversified exposure to a basket of stocks.

KOT4X’s commitment to expanding its instrument selection ensures that traders have access to a diverse range of assets, catering to various trading styles and risk profiles. Whether you’re a seasoned forex trader, a cryptocurrency enthusiast, or seeking exposure to traditional stocks and indices, KOT4X provides a comprehensive platform to pursue your trading aspirations.

Might be interested: Review of Cyprus broker 1Market

KOT4X regulation

KOT4X is regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines (SVG FSA). The SVG FSA is a regulatory body responsible for overseeing the financial services industry in St. Vincent and the Grenadines. It is responsible for issuing licenses to financial institutions, setting and enforcing prudential requirements, and investigating and prosecuting financial misconduct.

The SVG FSA conducts regular audits of KOT4X to ensure that it is complying with all applicable regulatory requirements. It also investigates any complaints received from clients and takes appropriate enforcement action against KOT4X if it breaches any regulations.

Overall, KOT4X is a reputable and well-regulated forex and cryptocurrency broker. The fact that it is regulated by the SVG FSA provides some level of protection for clients. However, it is important to be aware of the limitations of regulation and to conduct your own research before opening an account with any broker.

Here are some resources where you can learn more about forex and CFD broker regulations:

- Financial Conduct Authority (FCA): https://www.fca.org.uk/

- Securities and Exchange Commission (SEC): https://www.sec.gov/

- Australian Securities and Investments Commission (ASIC): https://asic.gov.au/

Account types

OT4X offers four main account types: Standard Pairs, Pro Pairs, VAR Pairs, and Mini Pairs. These account types differ in terms of their minimum deposit, spreads, commissions, and maximum leverage.

Standard Pairs Account:

- Minimum deposit: $10

- Spreads: Starting from 0.7 pips

- Commissions: None

- Maximum leverage: 1:500

The Standard Pairs Account is the most basic account type offered by KOT4X. It is a good choice for beginners who are just starting out with forex trading.

Pro Pairs Account:

- Minimum deposit: $500

- Spreads: Starting from 0.3 pips

- Commissions: $3 per lot round turn

- Maximum leverage: 1:500

The Pro Pairs Account is designed for more experienced traders who are looking for tighter spreads. The commission charged on this account is slightly higher than the Standard Pairs Account, but the tighter spreads can make it more profitable for active traders.

VAR Pairs Account:

- Minimum deposit: $25,000

- Spreads: Variable

- Commissions: None

- Maximum leverage: 1:500

The VAR Pairs Account is a variable spread account, which means that the spreads can change depending on market conditions. This account is designed for professional traders who are looking for the best possible execution.

Mini Pairs Account:

- Minimum deposit: $10

- Spreads: Starting from 2 pips

- Commissions: $6 per lot round turn

- Maximum leverage: 1:500

The Mini Pairs Account is similar to the Standard Pairs Account, but it is designed for micro-lot traders. This means that you can trade smaller lot sizes, which can reduce your risk.

In addition to these four main account types, KOT4X also offers an Islamic Account:

Islamic Account:

- Minimum deposit: $10

- Spreads: Starting from 0.7 pips

- No swap fees

- Maximum leverage: 1:500

The Islamic Account is designed for Muslim traders who are not allowed to pay or receive swap fees. This account is also available with any of the four main account types.

Table summarizing the key features of each account type:

| Account Type | Minimum Deposit | Spreads | Commissions | Maximum Leverage |

|---|---|---|---|---|

| Standard Pairs | $10 | Starting from 0.7 pips | None | 1:500 |

| Pro Pairs | $500 | Starting from 0.3 pips | $3 per lot round turn | 1:500 |

| VAR Pairs | $25,000 | Variable | None | 1:500 |

| Mini Pairs | $10 | Starting from 2 pips | $6 per lot round turn | 1:500 |

| Islamic | $10 | Starting from 0.7 pips | No swap fees | 1:500 |

Read also: Ozios Broker review [Updated]

Pros

- Competitive spreads and commissions

- High leverage

- Multiple account types

- Variety of trading platforms

- Excellent customer support

Cons

- Relatively new broker

- Regulated by FSA of St. Vincent and the Grenadines, which is a less stringent regulator than some other jurisdictions

Our Rating

KOT4X presents a compelling option for experienced cryptocurrency traders seeking a platform with high leverage, multiple account types, and the familiar MT4 interface. The ability to deposit and withdraw with cryptocurrencies further enhances its appeal in that specific market. However, the lack of clear regulation is a significant cause for concern. For new traders or those risk-averse, KOT4X’s limited track record and crypto-only payment methods might be drawbacks.

Ultimately, the decision depends on your individual trading goals and risk tolerance. If transparency and regulation are top priorities, KOT4X might not be the ideal choice. However, for experienced crypto-savvy traders comfortable navigating a less-regulated environment, KOT4X’s features and low minimum deposit are worth considering. Just remember, always do your own research and never invest more than you can afford to lose.