FTMO is an innovative company looking for successful traders. Of course, understanding who is a good or a bad trader can be a difficult task. That’s why the company created a trading course consisting of a two-step assessment process that would allow them to determine if a trader has all the qualities they are looking for.

If you succeed in the trading course, you will be able to participate in trading at FTMO Proprietary Trading. Users can manage accounts up to 100,000 USD. To understand if you are a successful trader, you would have to use educational applications, account analysis and performance psychologists.

Table of Contents: FTMO Review

How FTMO works

If you believe you are a good trader, you can start generating money not only with your funds but also by managing the company’s capital up to 300,000 USD. This can be a great opportunity for users to get started in the financial market.

Selected traders will be able to dispose of the company’s funds and keep 70% of the profits as a profit share. The company in turn will receive 30% of the profits. However, the FTMO explains that this can be difficult.

FTMO will take this position very seriously. Traders will trade freely but must follow certain rules such as avoiding excessive trading, trading for revenge and excessive use of the leverage, among others. Risk management is a very important pillar of a successful trader and FTMO takes this into consideration.

Understanding FTMO’s scaling plan

FTMO has also created a scaling plan that applies to the most successful traders. Users who show clear results get higher account balances. This way, investors can increase their account balances and increase their opportunities.

This can help them scale their positions without having to take higher risks. Still, there will be periods when traders will not make profits. Trading is a risky business and the firm does not promise users high returns.

Basically, a trader must have added at least 10 more percentage points in four consecutive months. In addition, the trader’s balance must be higher than the initial capital in order to scale. In this way, the company will give the trader a 25% balance increase after four months.

This shows that the trader will be able to double the capital and increase the loss limits. The goal is to push traders to make steady profits and reduce risk as much as possible.

Don’t miss this review: Wonderinterest Trading Ltd. Review

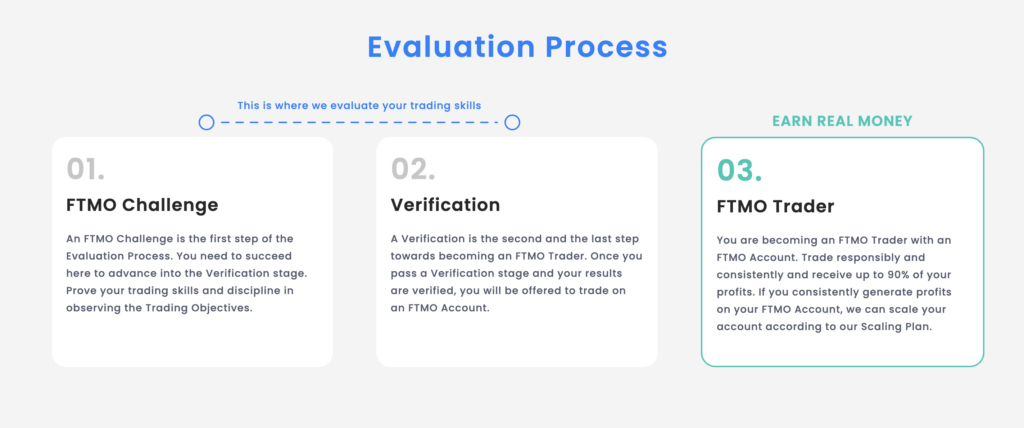

FTMO Trading Challenge

The FTMO Trading Challenge is a special two-stage process in which traders’ skills are carefully evaluated and tested. In the first stage, known as the evaluation stage, traders are provided with a demo account with a significant balance that mimics real market conditions.

This phase is crucial for traders to demonstrate their skills in meeting specific trading objectives such as profit targets and maximum loss limits. The task not only assesses the trader’s ability to achieve profits, but also emphasizes the importance of risk management, strategy effectiveness and trading discipline.

Traders must follow a set of rules, including maximum daily and total loss limits, and achieve a set profit target within a specific period. This process ensures that only those who take a consistent and disciplined approach to trading can progress.

The second phase, the verification phase, further tests the trader’s skills under slightly altered conditions and ensures that their strategy is robust and adaptable. Successful completion of both phases provides the trader with access to an accumulation account in which they can trade FTMO capital and earn a share of the profits.

FTMO provides traders with the ability to leverage at a professional level of 1:100, expanding their trading opportunities. This level of leverage allows traders to control a large position with relatively little capital, maximizing potential profits and losses.

High leverage is a significant advantage for traders who have a clear understanding of risk management and want to take advantage of market opportunities.

You can pay for the FTMO Challenge by bank transfer, debit/credit card, cryptocurrencies, Google Pay or Skrill.

Educational programme

The FTMO Training Programme is a set of resources designed to enhance the knowledge and skills of its users in the field of trading. The program covers a wide range of topics from technical and fundamental analysis to risk management and is designed for both novice and experienced traders.

The educational content is carefully designed to provide a deep understanding and practical insight into the dynamics of the financial markets. It includes instructional videos, webinars, articles and interactive tools aimed at providing a deeper understanding of trading strategies and market behaviour.

Read more: An introduction to exchange-traded funds (ETFs)

The program also focuses on the psychological aspects of trading and helps traders develop the mental resilience and discipline necessary for successful trading.

By offering continuing education opportunities, FTMO ensures that its traders are well prepared to adapt to changing market conditions and maintain a competitive advantage. The program does not just focus on theory; it also includes practical exercises and challenges that allow you to apply learned concepts to real trading scenarios, bridging the gap between knowledge and practice.

The Mentor app

FTMO’s Mentor app is an innovative tool designed to help traders adhere to their trading plans and effectively manage risk. The app serves as a personal trading coach that continuously monitors a trader’s compliance with predetermined trading goals and risk parameters.

It provides real-time feedback and alerts to help traders stay within their risk limits and avoid impulsive decisions that can lead to significant losses. The Mentor app is particularly useful in developing discipline, a critical trait for long-term trading success.

FTMO’s technology and tools

FTMO equips traders with the latest technology and tools needed for modern trading. The platform’s browser and mobile app are designed for seamless trading and efficient performance analysis. These tools provide traders with a robust and intuitive interface for market analysis, trade execution and monitoring.

The platform technology supports a wide range of trading tools and integrates seamlessly with popular trading platforms such as MetaTrader 4 and 5, providing flexibility and convenience.

Real-time data streams, advanced charting tools and a range of technical indicators are available to help traders make informed decisions. The mobile app ensures that traders can stay connected to the markets and their accounts even when they are on the move.

Payout system on FTMO

The FTMO payout system is designed with flexibility and profitability for traders in mind. The default payout ratio for FTMO traders is a generous 80%, but the benefits don’t end there. Traders have the option to request payouts on demand, giving them financial flexibility and control over their income.

The payout process is optimised and can start as early as 14 days after trading, and you can choose or change your profit share day up to three times. This system ensures that traders receive their earnings at the most convenient time for them.

FTMO: In conclusion

FTMO is a private trading company. It offers traders a unique opportunity to gain access to significant trading capital through its valuation process.

The platform is ideal for experienced retail traders and provides an innovative and modern trading environment. Traders start with the FTMO Challenge, where they demonstrate their trading skills and discipline in a simulated environment.

What may interest you: Unveiling Trading 212 – A comprehensive review

Pros

✅ Access to large trading capital

✅ High profit share

✅ Advanced trading tools

✅ Educational resources

Cons

❗️ Strict business objectives

❗️Geographical constraints