While CedarFx might present itself as a haven of attractive investment opportunities, it’s crucial to look beyond the surface. But is CedarFx a secure and trustworthy platform for your hard-earned money?

The answer, unfortunately, leans towards caution. CedarFx lacks a key element that fosters trust in the financial world: regulation by a reputable financial authority. Financial regulators establish and enforce strict standards to protect investors. These standards cover a wide range of areas, including:

- Client fund security: Regulators ensure that brokers segregate client funds from their own company funds. This protects your money in case the brokerage encounters financial difficulties.

- Fair trading practices: Regulations aim to prevent manipulative market practices and ensure a level playing field for investors.

- Transparency and accountability: Regulated brokers are required to disclose relevant information about their operations and fees. This allows investors to make informed decisions.

Without the oversight of a stringent financial authority, Cedarfx operates in a less transparent and accountable environment. This lack of regulation raises significant concerns about the safety of your funds and the fairness of the trading experience.

Therefore, we strongly advise against opening an account with Cedarfx. Instead, focus your search on brokers that are overseen by a top-tier and well-respected financial regulator. This will provide you with a much higher degree of security and peace of mind when navigating the world of investments. Remember, taking the time to choose a properly regulated broker is an essential step towards protecting your financial well-being.

CedarFX Review – Table of Content

Security of CedarFX

CedarFX keeps clients funds in segregated accounts from the company’s funds.

Trading Platforms

CedarFX offers downloads for MT4 for Windows, MT4 Android, MT4 iOS and Web Trader platforms.

Trading

- Real-time quotes of Forex market

- Full set of trade orders, including pending orders

- All types of trade execution

- Detailed online trading history

Advanced Trading

- Fast switching between financial instruments on charts

- Sound notifications assisting trading

- Customizable Forex chart color schemes

- Trade levels visualizing the prices of pending orders, as well as SL and TP values on the chart

- Free financial news — dozens of materials daily

- Chat with any registered MQL5.community trader

- Support of push notifications from the desktop MetaTrader 4 (MT4) platform and MQL5.community services

- Connection with hundreds of Forex Brokers

Technical Analysis

- Interactive real-time Forex charts with zoom and scroll options

- 30 of the most popular technical indicators among traders

- 24 analytical objects: lines, channels, geometric shapes, as well as Gann, Fibonacci and Elliott tools

- 9 timeframes: M1, M5, M15, M30, H1, H4, D1, W1 and MN

- 3 types of charts: bars, Japanese candlesticks and broken line for efficient trading

Accounts

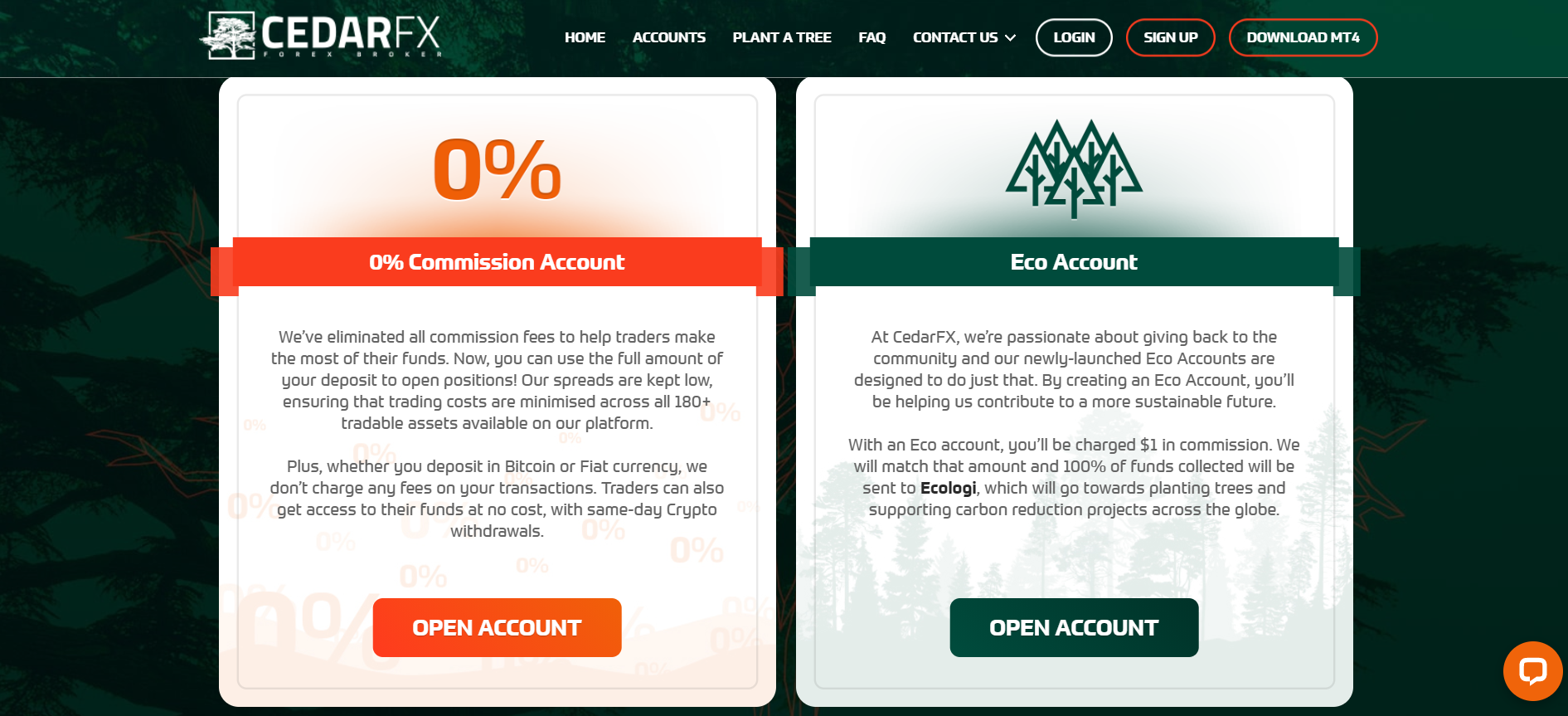

- 0% Commission Account

- Eco Account

Costs

CedarFX offers low variable spreads, maximum leverage of 1:500, zero commission and minimum deposit of $10. Deposits and withdrawals can be done via bank wire transfers, bitcoin and debit/credit cards.

Client Support

CedarFX provides 24/7 client support via live chat, email, and call back.

Regulation of CedarFX

CedarFX is not a regulated broker.

That’s a very important point. The lack of regulation with CedarFX is a major red flag for any potential investor. Here’s why it matters so much:

- Unprotected Funds: When a broker is regulated, they’re required to segregate client funds from their own company funds. This means your money is held in a separate account and shouldn’t be used by the broker for their own purposes. If CedarFX faced financial difficulties, there’s no guarantee your money would be safe.

- Potential for Manipulation: Regulated brokers have to follow strict rules to prevent manipulative trading practices. This protects you from unfair advantages being taken by the broker or other traders. Without regulations, there’s a higher risk of the market being rigged against you.

- Lack of Transparency: Regulated brokers are required to disclose important information about their fees, trading conditions, and risk factors. This allows you to make informed decisions about your investments. With CedarFX, you might not get the full picture, making it difficult to assess the true risks involved.

- Limited Dispute Resolution: If you have a problem with a regulated broker, there are usually established channels for resolving the issue. This might involve a complaint process or even arbitration. Without regulations, your options for resolving disputes with CedarFX could be very limited.

Overall, the lack of regulation exposes you to a much higher degree of risk with CedarFX. It’s best to choose a broker that operates under the watchful eye of a reputable financial authority.

Here are some resources where you can learn more about forex and CFD broker regulations:

- Financial Conduct Authority (FCA): https://www.fca.org.uk/

- Securities and Exchange Commission (SEC): https://www.sec.gov/

- Australian Securities and Investments Commission (ASIC): https://asic.gov.au/

Conclusion

In conclusion, while CedarFX may beckon with promises of exciting investment opportunities, it’s a platform best approached with caution. The absence of regulation by a respected financial authority raises serious concerns about the safety of your funds and the fairness of the trading environment. When dealing with your hard-earned money, transparency, accountability, and fair play are crucial. Regulated brokers provide these safeguards, while CedarFX leaves you exposed to a multitude of risks. Look beyond the initial allure and prioritize your financial security. Choose a broker that operates under the strict oversight of a top-tier financial regulator. It’s a decision that will give you peace of mind and a much stronger foundation for your investment journey.