Robo Markets is an international broker that‘s been in operation since 2012 and has been providing diverse financial services/assets to traders across the globe in the financial market. Robo Markets financial instruments include Currencies, Stocks, Indices, Cryptocurrencies, Commodities, ETFs, Metals, and Energies.

Table of Content

Security

Robo Markets is a member of the Investor Compensation Fund and provides Civil Liability Insurance Policy for client‘s up to 5,000,000 EUR.

Trading Platforms

Robo Markets provide a MT4, MT5, R StocksTrader, and R WebTrader platforms.

MetaTrader 4

- Includes interactive charts for analysis with 9 timeframes to choose from.

- Has 30 built-in indicators for technical analysis.

- The trading platform offers 4 types of stop and limit orders: Buy Stop, Buy Limit, Sell Stop, Sell Limit.

- Allows opening only hedging accounts.

- MT4 is developed for trading primarily CFD instruments.

MetaTrader 5

- Includes interactive charts for analysis with 21 timeframes to choose from.

- Has 38 built-in indicators for technical analysis.

- Provides access to a free economic calendar.

- МТ5 platform allows both hedging and netting.

- MT5 offers tools for trading stocks, indices, and currencies (forex).

R StocksTrader

- Convenient and easy-to-use.

- The initial deposit is 100 USD.

- Stocks leverage is up to 1:20.

- Includes Level II Market Depth and Time&Sales.

- Provides a free trading robots builder.

R WebTrader

- Includes 9 tools for graphic analysis.

- Has 13 indicators.

- Gives access to exclusive analytics from RoboMarkets.

- Supports all types of MT4 accounts.

- Provides online monitoring of quotes without delays.

Analytics

- Currency Analysis & Forecasts

- Economic Calendar

- Webinars

- Blog

Trading Tools

- R StocksTrader Strategy Builder

- Trading Calculator

- Financial Charts

Education

- How to Open an Account

- How to Start Trading

- RoboMarkets FAQ

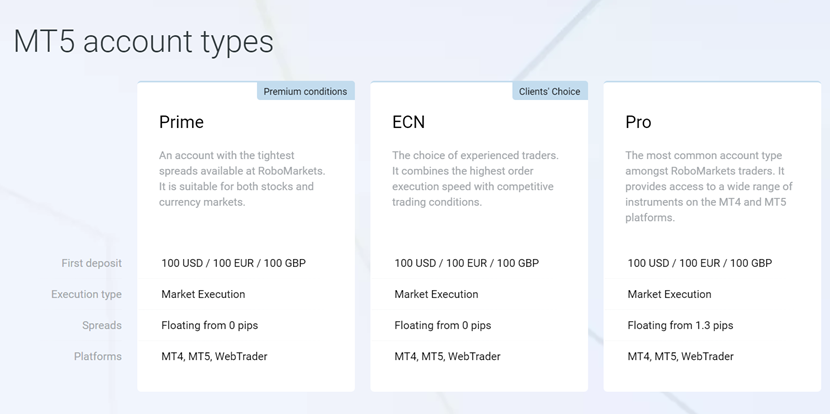

Accounts

- Cent

- ECN

- Prime

- Demo

Costs

Robo Markets offer maximum leverage of 1:30, floating spread from 0 pip, and minimum deposit of $100. Deposit can be made via bank transfer, giropay, visa/master cards, skrill, neteller, paypal, and more.

Bonuses

- Classic Bonus

- Profit Share Bonus

Customer Support

Robo Markets provide 24/7 multilingual customer support via chat, email, and telephone.

Regulation

- Cyprus Securities and Exchange Commission (CySEC).

Conclusion

Robo Markets is an international broker that is regulated by the Cyprus Securities and Exchange Commission and is a member of the Investoir Compensation Fund. Robo Markets provide diverse trading instruments for traders to trade on using unique platforms. Robo Markets also offer multiple account types with maximum leverage of 1:30, floating spread from 0 pip, and minimum deposit of $100. Traders have access to trading tools, education, analytics, fast and easy deoposits, segregated client accounts,, bonuses, and 24/7 mulitlingual customer assistance.