GCI is an online Forex and CFD broker thats‘ been providing excellent tarding services since its establishment in 2002. GCI gives all traders direct access to trade on over 300 diverse trading instruments in the trading markets. GCI provides 6 asset-classes such as Forex, Shares, Metals, Commodities, Indices and CFDs.

Security

GCI ensures that all clients‘ funds are kept in segregated accounts from the company’s own funds.

Trading Platforms

GCI provides a Metatrader and ActTrader platform. These platforms can be accessed through PC, web and mobile devices.

The MetaTrader 4

- Trade 6 asset classes

- Instant and Market execution

- Fixed and floating spreads

- All Expert Advisors supported

ActTrader

- Forex, Gold, Indices and more

- Spreads starting at 0.0

- No requotes

- Algo trading supported

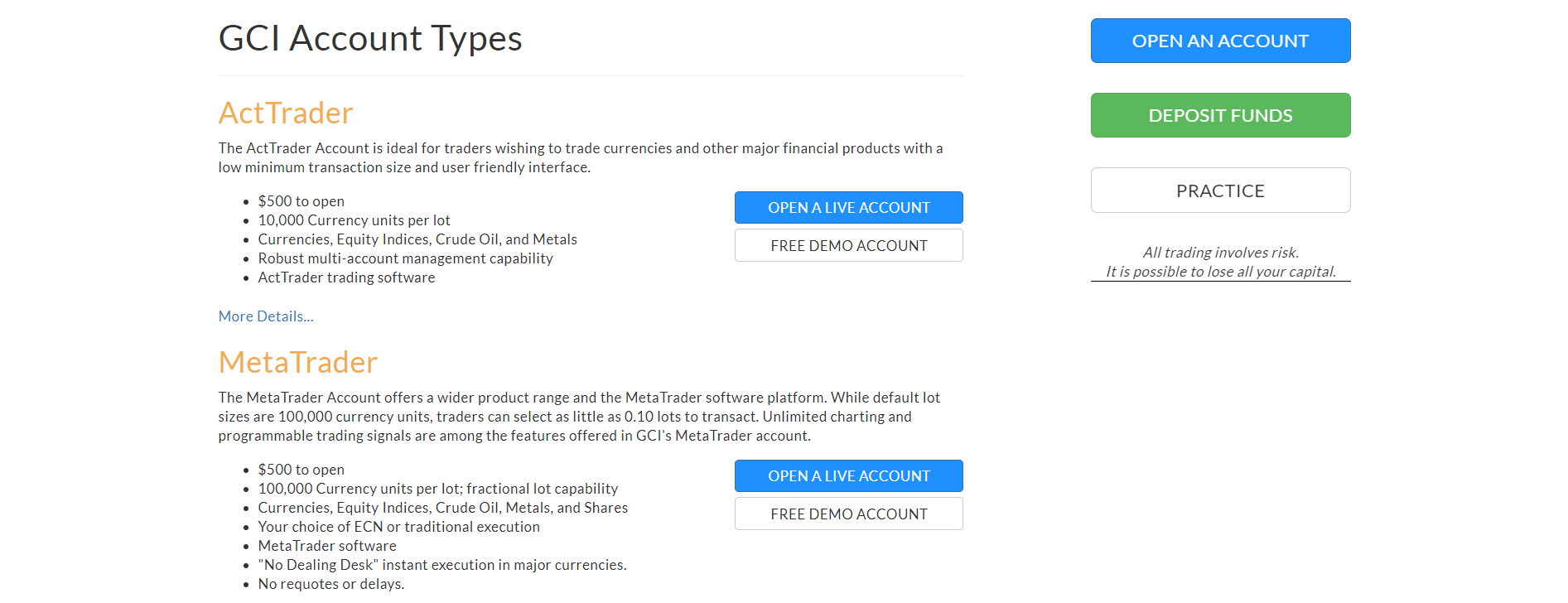

Accounts

- ActTrader

- MetaTrader

- Demo

Education & Resources

- Overview

- Forex Education

- Live Forex Quotes

- Currency Converter

- Daily News

- Forex Charts

- Trading Signals

- Forex Economic Calendar

Fees

GCI offers spreads from 0.0, maximum leverage up to 1:400, zero commission and minimum deposit for a new trading account is $500. Deposits/withdrawals can be made through bank wire, skrill, perfectmoney and neteller.

Client Support

GCI offers 24/5 client support in diverse languages via live chat, email, and telephone calls.

Regulation

GCI is not a regulated broker.

Conclusion

GCI is an online Forex and CFD broker thats‘ been providing excellent tarding services across 6 asset-classes including Forex, Shares, Metals, Commodities, Indices and CFDs. GCI provides a MetaTrader and a ActTrader platforms, maximum leverage up to 1:400, spreads from 0.0 and minimum deposit of $500 to open an account. GCI ensures segregation of clients funds and provides 24/5 multi-lingual client support, However, GCI is not a regulated broker.