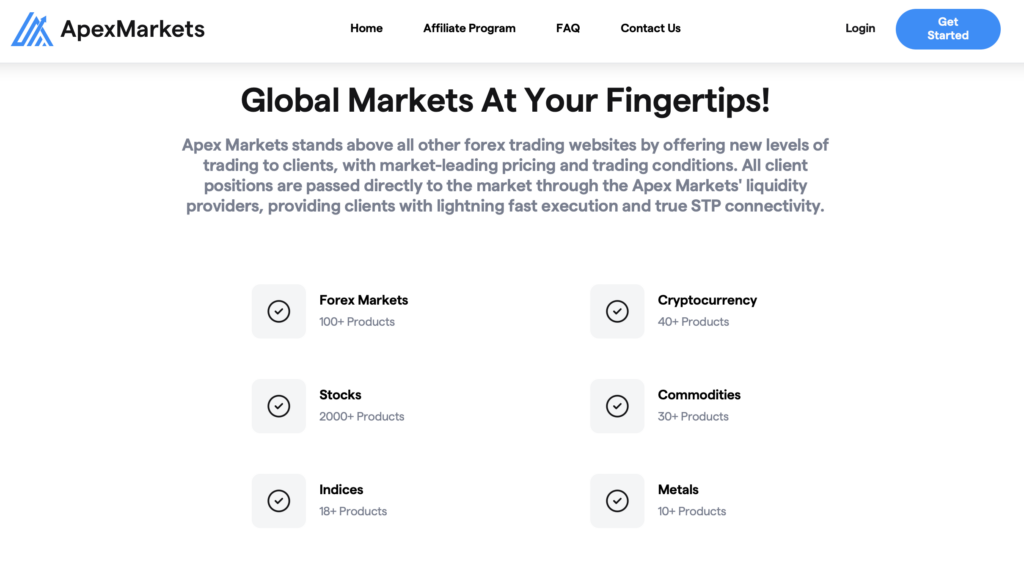

Apex Markets is an online Forex broker that’is known to provide financial investment services to traders all over the world. Apex Markets give traders direct access to reliable and transparent trading instruments in the financial market. Apex Markets financial instruments include Forex, Stocks, Metals, Indices, Commodities, and Cryptocurrencies.

Apex Markets – Table of Content

Key features of Apex Markets

- Competitive spreads: Apex Markets offers some of the lowest spreads in the industry.

- Wide range of trading products: Apex Markets offers a wide range of trading products to suit all traders’ needs.

- Advanced trading platforms: Apex Markets offers a variety of advanced trading platforms, including MetaTrader 4 and 5.

- 24/5 customer support: Apex Markets offers 24/5 customer support in multiple languages.

Don’t miss: BITmarkets.com review – regulated crypto market

Apex Markets – Is it safe?

Apex Markets has mixed reviews online. Some traders have praised the broker for its competitive spreads, wide range of products, and advanced trading platforms. However, other traders have complained about the broker’s lack of regulation and customer service issues.

Overall, Apex Markets is a reputable broker that offers a variety of trading products and services. However, it is important to do your own research before opening an account with any broker.

Here are some additional things to keep in mind about Apex Markets:

- Apex Markets is not regulated by any major financial regulator.

- Apex Markets offers a variety of bonuses and promotions, but it is important to read the terms and conditions carefully before accepting any offers.

- Apex Markets has a variety of educational resources available to its clients.

Security

Apex Markets provides data encryption and compliance with PCI DSS standards to safeguard client’s funds.

Apex Markets Trading Platforms

Apex Markets offers two primary trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely used and renowned for their advanced features, flexibility, and customizability. Here’s a brief overview of each platform:

MetaTrader 4 (MT4)

MT4 is the more established and popular platform, known for its simplicity, intuitive interface, and extensive range of trading tools and indicators. It caters to both beginner and experienced traders and offers a comprehensive set of features for technical analysis and trade execution.

Key features of MT4:

- Technical analysis tools: MT4 provides a vast array of technical indicators, chart patterns, and drawing tools to assist traders in analyzing market trends and making informed trading decisions.

- Automated trading: MT4 supports automated trading strategies through the use of Expert Advisors (EAs), allowing traders to execute trades based on predefined rules and algorithms.

- Customizable interface: MT4 offers a high degree of customization, enabling traders to personalize their trading environment by adjusting the layout, colors, and indicators.

MetaTrader 5 (MT5)

MT5 is the newer and more advanced platform, built upon the foundation of MT4. It offers a wider range of assets, including forex, indices, commodities, stocks, and cryptocurrencies. MT5 also introduces several enhancements, such as:

- Multi-asset trading: MT5 allows traders to trade multiple asset classes within the same platform, simplifying portfolio management.

- Improved charting: MT5 provides enhanced charting capabilities with more advanced indicators, drawing tools, and technical analysis features.

- Algorithmic trading: MT5 offers a more robust framework for algorithmic trading, supporting both visual and text-based programming languages.

Choosing between MT4 and MT5:

The choice between MT4 and MT5 depends on your trading style and preferences. For beginners and traders primarily focusing on forex, MT4 may be sufficient due to its simplicity and established user base. For more experienced traders seeking advanced features and multi-asset trading capabilities, MT5 is a better option.

Regardless of the platform you choose, Apex Markets provides comprehensive support materials and tutorials to help you get started and navigate the platform effectively. Both MT4 and MT5 offer downloadable versions for desktop computers and web-based versions for convenient access. Additionally, mobile apps are available for Android and iOS devices, allowing you to trade on the go.

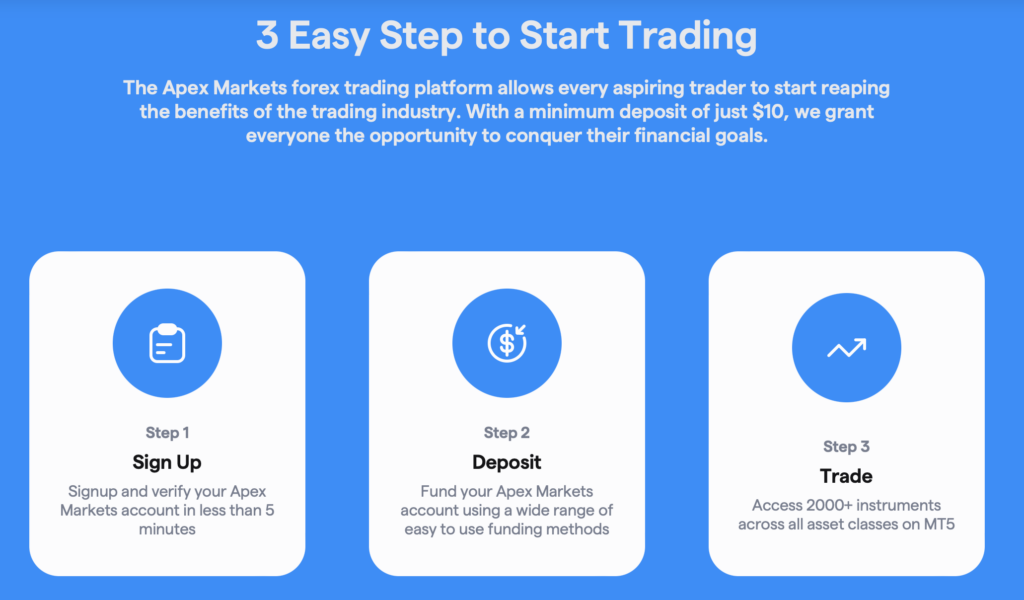

Apex Markets Minimum Deposit

Apex Markets requires a minimum deposit of $10 USD to open an account. However, if you deposit $100 USD or more, you will receive a welcome deposit bonus. These points can be redeemed for cash or prizes.

Also read: InvestaGO – Invest with a regulated broker

Apex Markets Accounts

Apex Markets offers a single account type, the Pro Account, which is designed to cater to traders of various skill levels and trading styles. Here’s a summary of the Pro Account features:

- Minimum deposit: $10

- Spreads: Competitive variable spreads starting from 0.0 pips on popular forex pairs

- Leverage: Up to 1:500 for experienced traders

- Trading instruments: Forex, cryptocurrencies, indices, stocks, and commodities

- Trading platforms: MetaTrader 4 and MetaTrader 5

- 24/7 customer support: Available in multiple languages

The Pro Account offers a balance of competitive pricing, flexible leverage, and a wide range of trading instruments, making it a suitable choice for traders of different levels and preferences.

Costs

Apex Markets’ costs of trading and fees can be categorized into three main types: spreads, commissions, and fees for additional services.

Spreads: Spreads are the difference between the bid and ask prices of an asset. They represent the broker’s profit from each trade. Apex Markets offers competitive spreads starting from 0.0 pips on major forex pairs, which is considered low in the industry.

Commissions: Commissions are additional fees charged by brokers for executing trades. Apex Markets charges a commission on forex trades based on the volume of each trade. The commission rate varies depending on the asset being traded and the account type.

Fees for additional services: Apex Markets also charges fees for various additional services, such as:

- Reversal fees: Fees charged if a trader cancels a pending order before it is executed.

- Inactivity fees: Fees charged if a trader’s account remains inactive for a certain period of time.

- Excess leverage fees: Fees charged if a trader’s leverage exceeds the maximum allowed by the account type.

Overall, Apex Markets’ costs of trading and fees are relatively low compared to other brokers in the industry. The broker offers competitive spreads, no account inactivity fees, and a low maximum leverage of 400:1. However, traders should be aware of the potential fees for additional services, such as reversals and inactivity.

Here’s a table summarizing the key fees charged by Apex Markets:

| Trading instrument | Spread | Commission | Reversal fees | Inactivity fees | Excess leverage fees |

|---|---|---|---|---|---|

| Forex | Starting from 0.0 pips | Based on volume | $5 | None | None |

| Cryptocurrencies | Starting from 1.0 pips | None | $5 | None | None |

| Indices | Starting from 0.8 pips | None | $5 | None | None |

| Stocks | Starting from 0.05 USD per share | None | $5 | None | None |

| Commodities | Starting from 0.5 pips | None | $5 | None | None |

Customer Support

Apex Markets offers a variety of customer support channels to assist traders in their trading journey. Here’s an overview of their customer support options:

24/5 Live Chat: Apex Markets provides 24/5 live chat support via their website. This is a convenient and efficient way to get real-time help with any trading-related questions or issues.

Email Support: Apex Markets also offers email support, which is available 24/7. You can submit your questions or concerns via email and expect a response within a reasonable timeframe.

FAQs: Apex Markets maintains a comprehensive FAQ section on their website, covering a wide range of topics related to trading, account management, and technical issues. The FAQs can be a valuable resource for self-help and common inquiries.

Community Forum: Apex Markets also has a community forum where traders can interact with each other, share ideas, and seek help from fellow traders. This can be a helpful resource for getting insights and perspectives from experienced traders.

Telephone Support: Apex Markets provides telephone support for traders from certain regions. However, the availability of telephone support may vary depending on your location.

Overall, Apex Markets offers a robust customer support system with various channels to cater to different preferences and communication styles. Their 24/5 live chat is particularly convenient for traders seeking immediate assistance. The FAQs and community forum can also be valuable resources for self-help and seeking peer-to-peer support.

Apex Markets contact number

Apex Markets provides telephone support for traders from certain regions. However, the availability of telephone support may vary depending on your location. The best way to contact this broker is to e-mail them on support@apexmarkets.io .

Regulations

Apex Markets is an unregulated broker.

Advantages

- Competitive spreads: this broker offers some of the lowest spreads in the industry, starting from 0.0 pips on major forex pairs. This means that traders pay less for each trade, leading to higher potential profits.

- Wide range of trading instruments: broker offers a wide range of trading instruments, including forex, cryptocurrencies, indices, stocks, and commodities. This gives traders more options to diversify their portfolios and find trading opportunities that align with their preferences.

- Advanced trading platforms: broker provides access to two popular trading platforms, MetaTrader 4 and MetaTrader 5. These platforms offer a wide range of features and tools for technical analysis, trade execution, and algorithmic trading.

- 24/7 customer support: broker provides 24/7 customer support in multiple languages. This ensures that traders can get assistance whenever they need it, regardless of the time zone.

- Educational resources: Apex Markets offers a variety of educational resources, including webinars, articles, and video tutorials. These resources can help traders learn about forex trading, develop trading strategies, and improve their trading skills.

- Minimum deposit: The minimum deposit for the account is $10.

Disadvantages

- Lack of regulation: Apex Markets is not regulated by any major financial regulator. This means that it is not subject to the same standards of transparency and accountability as regulated brokers.

- Limited account types: the broker only offers a single account type, the Pro Account. This may not be enough for traders who have specific needs or trading styles.

- Mixed reviews: it has mixed reviews from traders online. Some have praised the broker for its competitive pricing and trading platforms, while others have complained about customer service issues and lack of regulation.

Overall, Apex Markets is a reputable broker with a good reputation for offering competitive spreads, a wide range of trading instruments, and advanced trading platforms. However, it is important to weigh the advantages and disadvantages carefully before deciding to open an account with this broker.

Don’t miss: Ozios broker – Regulated and Safe

Apex Markets Conclusion

Ape Markets is an online broker that provides a wide range of trading instruments such as Forex, Stocks, Commodities, Cryptocurrencies, and Indices. Apex Markets provides an Apex Pro account with spread from 0.0 pips, leverage up to 1:500, and minimum deposit of $10. Apex Markets also provides the MetaTrader 5 trading platform, fast and easy deposits, and 24/7. customer support. However, Apex Markets is an unregulated broker

Have a look at other reviews here.