Many of you will remember the technology company Meta Platforms under its original name, i.e. Facebook. Anyway, Meta Platforms is a relatively young brand that has only been with us for a little over a year (as of October 2021). Its predecessor, Facebook, entered the stock exchange only 11 years ago. Meta’s shares, or rather Facebook’s, were quite widely sought after from the very beginning, and this is doubly true after last year’s slump. If you are wondering how to take advantage of the current good buying opportunity, the following lines are for you.

Content

Introducing Meta Platforms

As already said, the company Meta Platforms saw the light of day at the end of October 2021. But in fact it was just a renaming of Facebook, which bore the same name as one of the most widespread and popular social networks. Facebook itself was founded by Mark Zuckerberg with several of his classmates from Harvard University.

However, it was originally named FaceMash and was created in 2003, then even more as an indication of a social network and not a business brand. It got its name Facebook in February 2004. From this moment on, you can talk about Facebook as a company or a start-up.

In just a few years, Facebook has developed so much that investors have become interested in it. And so it was only a matter of time before Facebook headed for the stock exchange. This happened on May 18, 2012, when the share price was $38, and the market capitalization was around $90 billion.

The renaming of Facebook to Meta Platforms happened mainly because Facebook no longer meant only the network of the same name. It became a holding company that gradually created or absorbed other social networks or mutual communication tools. According to Mark Zuckerberg, the name Meta Platforms is a much better representation of what the tech giant is all about. In addition to Facebook, Meta also includes the popular Instagram network, communication applications WhattsApp and Messenger.

Read this: INVESTAGO Company Review

Where to buy Meta shares

A fairly large number of players have started thinking about investing in Meta Platforms shares in recent weeks and a few months. It’s not surprising, since the stock markets have gone through a rather steep fall in the past year, and the shares of technology companies, including Meta Platforms, have become the sad heroes.

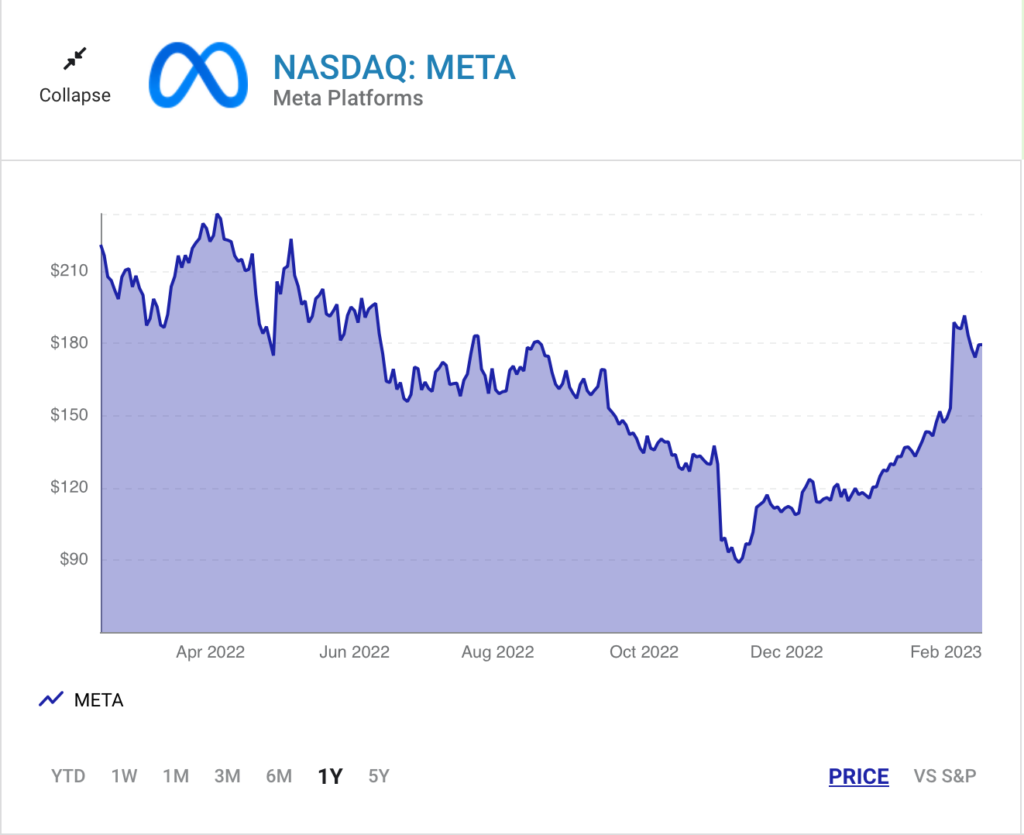

Therefore, many investors are convinced that this is still a quality buying opportunity. The value of Meta’s shares fell by about 45 percent since the beginning of last year, while at the beginning of last November there was a reversal of the trend, and since then Meta has strengthened by about 80 percent.

The easiest way to access Meta Platforms shares is through one of the investment apps. There are a really large number of them on the market, so it pays to bet more on the established and proven ones.

How to buy Meta shares safely and efficiently

However you decide to invest in Meta Platforms shares, it will always mean that you are doing so through an intermediary, i.e. a broker. As an ordinary mortal, you do not have the opportunity to invest in the stock market directly. This can only be done by brokers who are authorized to do so.

A broker is like your extended arm that executes your buy and sell orders in a given stock market. So it means that the broker is not responsible for your investment decisions, it just does what you tell it to do. Either through an investment portal, an investment application or (by a guardian) over the phone. However, every serious broker should have you fill out an investment questionnaire and familiarize you with the risks of investing on stock exchanges.

Different ways of investing have their advantages and disadvantages. For those who are sure of their own judgment, the speed with which they will be able to execute their orders to buy or sell (not only) Meta Platforms shares will probably be important to them. In such a case, using one of the investment applications appears to be the most advantageous. Another advantage is that they charge minimal fees for buying or selling shares, sometimes you can even come across an offer that does not charge any fees.

On the other hand, investing in the “old school” style is a slower way, but it gives you the opportunity to consult your investment decision with a broker. But be careful, here you will usually pay higher fees for mediating such a purchase or sale of a specific share. You can find brokers in practically every bank, but there are also a number of brokerage companies on thru that offer brokerage services for the purchase or sale of shares.

But if you decide to invest in Meta Platforms shares through one of the apps, you have a pretty decent choice. In practically all investment applications, if you want to use the services of one of them, you will have to set up an account with it. This will be linked to your bank account, from which you will transfer the money intended for investment to the account of the selected application. This can also be done via payment card. At the same time, you will be able to transfer money from it back to your bank account. The choice of a specific investment application is then up to you. The most popular applications include eToro, XTB (XTrade Brokers), Crypto.com, but also Coinbase, Binance or Libertex.

If you are clear about how you are going to invest in Meta Platforms shares, you should also clarify what information you need to make at least a somewhat informed decision about when, in what volume, and how often you intend to buy Meta Platforms shares. invest, or under what circumstances you will get rid of them.

This is probably the trickiest thing about investing ever. The ideal investor is one who is not swayed by emotions. In the case of technology stocks, where Meta Platforms undoubtedly belongs, it is probably the most complicated. We often hear that technology stocks have fallen significantly, or on the contrary, started a sharp growth.

But what to believe, where to get the necessary information? It is definitely right to monitor the economic situation in the world. Economic development is directly reflected in the development of shares. The technological ones tend to be even more sensitive to the economic situation. It goes without saying that monitoring reports on the financial management of companies whose shares you are considering as an investment.

Also watch the behavior of central banks, which decide on the level of interest rates in the economy, which again significantly affects the stock markets. In general, when central banks tighten their policies, they take away liquidity from financial markets, which puts downward pressure on stock markets. Conversely, if central banks relax their policy and thus reduce interest rates, they de facto inject blood into the financial markets in the form of additional liquidity.

Meta shares and their price development

The technology sector tends to be more sensitive to these events, as we have seen several times in the past. Technology stocks tend to be prone to creating bubbles and then bursting them. It is quite logical, since technological companies are the bearers of technological progress, which is the only source of increasing living standards in the long run.

Therefore, if a technological innovation associated with a specific company appears on the market, investors do not hesitate and throw their money into buying its shares. Optimistic sentiment then usually spills over into the rest of the sector and technology as a whole grows. The trouble comes when the hopes placed in a given company turn out to be false. Then comes the fall just as quickly as the previous growth.

Technology companies experienced a rather steep fall last year, especially in its first half. The shares of Meta Platforms did not escape the bad mood of investors. Meta shares started last year at around $300. During the following months, however, they experienced an almost continuous decline.

They lost 70 percent of their market value before rebounding from an imaginary bottom at the beginning of last November. But since then, Meta’s shares have managed to strengthen relatively significantly (by about 80 percent), so today they are trading only about 15 percent lower than a year ago. Since the beginning of this year, the shares of Meta Platforms have strengthened by almost 44 percent.

But the question is where Meta shares are measuring right now. For the past five days, they have been steadily weakening again, and since the beginning of February they have already managed to lose about nine percent of their value. It is therefore a question of whether to wait for a possible purchase of Meta Platforms shares, or whether it is just a “break” on the way up.

Here we can apply some good advice when investing in any stocks. Let’s remember them. First, let’s not try to hit the bottom when buying stocks. That is, the price that is at some local (for example, quarterly, half-yearly, annual or multi-year) minimum. Stock markets usually work and move differently than we often think.

Second, let’s try to so-called dilute stock purchases. This means that we do not purchase shares all at once at some point in time, but buy them up gradually in smaller amounts. In this way, we dilute the risk that we will buy the share too expensively or less advantageously than it would have been if we had bought the given share, for example, a month ago in a larger volume.

Third, let’s keep calm. It is not wise to immediately consider selling the stock at the slightest drop in value, knowing that we will lose much more money if we continue to hold the stock. All the more so when it comes to Meta Platforms shares, which (as we have shown) are subject to relatively strong fluctuations recently. It is advisable to use the decline of the stock market to purchase specific shares at a favorable price.

So let’s conclude by summarizing how to buy Meta Platforms shares. First of all, you need to clarify why you are even considering investing in them. If you are determined to get them, the next step is to choose the best way to buy them. You basically have two options: use the services of a classic broker, with whom you can still consult your purchase, or invest using one of the above-mentioned (or other) applications.

Do not miss: Ozios Broker review [Updated]

Now that you have chosen the way to invest in Meta Platforms shares, go for it. But not headlong, but with a good sense of balance. If you want to invest in Meta for the long term, then it is better to buy shares gradually and so-called accumulate their holdings. On the one hand, you dilute the risk of buying at an inappropriate moment (not at an imaginary bottom), and on the other hand, you create a relatively powerful stock portfolio.

Also, don’t forget that you should diversify your investments, i.e. not focus only on a single type of asset. However, diversification should also take place within the framework of investments in a single asset (share), both from the point of view of the diversity of companies and from the point of view of time (we are already at the point of dilution).

And last but not least, follow the global economic development, the development of the technological segment, the development of the policy of central banks, the development of the financial situation of a specific company (in this case Meta Platforms), but also the intentions of its management. Long story short, always be careful and alert.