In this review, I would like to take a detailed look at one of the biggest players in the investment market in our country. It is a brokerage company LYNX.

Table of content

About LYNX

LYNX was founded in 2006 in the Netherlands and can currently be considered a major player in the financial and investment markets. At present, it can boast more than 60,000 investors, which is already a really big number. With this broker we can find a large number of trading opportunities. It can trade thousands of shares from European and American exchanges for clients, and trading with futures, options, or CDF contracts is a matter of course for this company.

LYNX is subject to regulations for the European market. This means that they follow very strict rules. In order for this broker to be able to trade on the Czech market, it is a matter of course to issue a license from the Czech National Bank. What is, however, very positive news (right at the beginning) is that the company and its website support the Czech language. Our clients therefore have their entry into the world of LYNX BROKER wide open.

The slogan on the first page that immediately caught my eye is: “take your investing to the next level”. So let’s see if this is true.

What they trade with

Broker LYNX can really boast of a wide range of its products and trading opportunities. They themselves talk about the fact that the client can use any trading strategy and any market so that it plays into the client’s hands and brings him a burdened profit.

Trading options:

- Stock

- General

- Futures

- ETF

- Forex

- CFD

- Penny stocks

- Certificates

Due to the fact that the company takes great pride in sufficient information for clients, each of these products indicates what the product means and what the company can do with it. Let’s imagine this now.

STOCK:

LYNX can trade shares directly on the largest exchanges around the world. We are talking about 150 exchanges in more than 33 countries. It can offer shares to all kinds of clients, whether private investors or swing traders. We can trade stocks long before the opening of the stock exchanges, but also long after that. (premarket and aftermarket) . Shares can also be combined with options for hedging or additional income. As a last thing, it is certainly worth mentioning that the broker provides free investment types and stock analysis.

GENERAL:

Options can be traded on stocks, index options, or options on futures. For this purpose, they again use exchanges around the world, and the most famous ones such as CME, CBOE or EUREX. It is certainly important to mention that LYNX has the most options trading opportunities on the Czech market. In addition, it offers its clients education in options trading completely free of charge and allows an unlimited amount of analysis of option combinations.

FUTURES:

Here it is probably very important to mention that you can trade futures with LYNX 24 hours a day, 5 days a week, on dozens of world futures exchanges. You could talk about an almost unlimited amount of futures trading – either to hedge your portfolio or speculate on price movements. LYNX have their trading platform directly specialized for futures. It is therefore truly a company that can meet the demands of even the most demanding clients.

ETF:

I like and really appreciate that in addition to the marketing move – that is, what the company can do and what it offers, we will also learn very interesting and also necessary information. Many investors know the product and know how to trade it. But what does an ETF actually mean? We will also find out about this on the www.lynxbroker.cz website . ETFs or Exchange Traded Funds, nebolik TRACKERS are among the most popular with investors, according to LYNX. They use them very often to diversify their investments and therefore do not risk so much. Perhaps the reason for this is cheap and very transparent fees.

FOREX:

The broker can boast an optimized trading platform for forex trading and the use of professional tools for very demanding trappers. It can trade forex in 25 currencies and gives its clients access to the market with 17 global banks. In case anyone is not sure about their knowledge, they allow free educational webinars. Of course, this applies not only to those who are not sure about information, but also to those who crave current news from the world of forex.

CFD:

For these products, the broker warns of a very high risk. I think this is really important. Clients need to know what risk they are taking if they want to take advantage of trading with leveraged products. For 69% of detail clients, this trading caused financial losses. However, if someone knows the risk and despite this, decides to go for this trade, he can also gain a lot. The company does not cause artificial expansion of spreads and allows direct market entry (DMA). It should also be noted that CFDs can be traded through many platforms for PC, mobile, but also tablet. There are low fees and they can trade more than 7,000 available products.

PENNY STOCKS:

LYNX allows its clients to trade pink sheet stocks, penny stocks and OTC stocks at a very low cost. These stocks are very popular with traders. Due to their low prices, they allow quick profits due to their high volatility. Shares with a price below $1 can be traded. However, if we go into detail and look at how they are defined by the Securities and Exchange Commission, we can find them here from $ 5 per share. It should also be mentioned that even these stocks are considered very risky. This trading is not offered by many brokers, so it can be said that LYNX is far above its competitors in this.

CERTIFICATES:

Like penny stocks, not every broker can trade certificates. LYNX BROKER can be proud of this. It can provide us with direct access to certificates from well-known issuers. In practice, this means that it can create more than 60 different orders and algorithms to streamline trading. What is interesting about certificates is the idea that for very small initial costs we can make interesting profits and there are no more losses than the amount invested. It is also possible to speculate on a decline in the traded asset without the need to meet high margin requirements.

Where do they trade?

LYNX BROKER offers trading all over the world. It prides itself on trading up to 150 stock markets in 33 countries and 25 currencies. This can tell us about the company that he is definitely no beginner in the world of finance and certainly not a small player. It can offer its services to retail investors, but also to those who invest millions of dollars.

Countries whose stock exchanges we can visit can be found in a well-arranged table. It is also possible to choose with a simple click which country and what exchange we want to trade.

Of course, LYNX’s offer includes the German market, where clients are primarily interested in buying shares in the booming automotive industry, or the American market, where investors are happy to send their financial amounts to the technology sector. We will be surprised, but also by other markets that offer very interesting investment opportunities. Such as Hungary, South Africa, Lithuania, or, for example, Singapore and Portugal.

If we talk about what exchanges we can visit thanks to this broker, it is worth mentioning definitely the most famous ones, such as the New York Stock Exchange, the NASDAQ technology exchange, the German Xetra Exchange, the London Stock Exchange, the Tokyo Stock Exchange in Japan or even the Canadian Toronto Stock Exchange.

What I really have to appreciate is the specific idea of the company so that the client can easily choose. On the company’s website you can choose in any way. Whether according to the product we want to trade, the currency we want to trade, or the market we want to visit. There is even a variant that you choose a specific one exchange and trade directly on it. Do you like the Asian Stock Exchange, for example? Do you believe in it? Do you want to buy a specific share of a particular company there? For LYNX broker this is not a problem. I would even say that it is very simple and achievable in a few steps.

Thanks to LYNX BROKER, you can become a GLOBAL INVESTOR, as they themselves state.

Managed account

The company offers to open a client account almost everywhere on the www.lynxbroker.cz website. From a marketing point of view, this is of course an excellent move, because we never know when we will think of opening an account and flying into the world of trading and investment.

Overall, I think there are plenty of lures for opening a client account. From the company’s motto: “Take your investing to the next level”, to an interesting website and an unlimited number of trading opportunities.

Before we move on to the client account information, I would like to focus on the so-called “information package”. It is the first broker where I see such a possibility. The reason is quite simple and simple. Investors place high demands on their brokers. LYNX strives to meet them and therefore starts right at the beginning. They will acquaint their potential clients with the company and what they offer. The client just fills in his contact details and immediately receives more information on his e-mail, and also as a bonus he gets the look of 11 super strategies of the biggest investment gurus. I’d say LYNX has really picked this up and it can be a big draw for marketers. It feels professional and very transparent. And that’s very important with finance.

Before you open an account, it is also necessary to say what benefits the opening of a client account will bring us.

- Low and transparent fees

- Advantageous currency conversions

- Stable and reliable trading platform

- Wide range of products and markets in which they trade

- Professional and friendly client service

- Comprehensive investment portal

It is also necessary to realize before opening a client account that investing is a serious matter. It’s about the money! LYNX points out that investing is not for everyone and this broker tries to take it really seriously. It is therefore important to meet the conditions for opening a client account.

- Minimum age 18 years

- Personal and joint account requires a minimum deposit of CZK 75,000, or the equivalent in another currency

- If you plan to trade products such as options and futures, you need to have at least 2 years of experience

If you meet this, it is not a problem to open a client account with LYNX BROKER.

I also greatly appreciate the fact that on the same page as the possibility of opening a client account, there is also information about support and the possibility of contacting the broker in case of any questions, uncertainties, or problems.

Lynx Trading platforms

LYNX claims that the trading platform is the most important tool of the investor. And again, I just have to agree. We can know how and where to invest, but if we do not have the right tool to do so, or if you want a platform, the trade may not succeed. And here we are again – it’s important, it’s about our money!

Previously, professional software was only available to large investors, corporations and other “professionals” in the industry. It was true, therefore, that only one who is already rich can get rich. However, LYNX broker definitely does not like this and they decided to solve the situation. And so that they have created several platforms that will allow anyone who wants it and goes for their goal – to invest and earn – to trade professionally. A quality trading platform should provide clients with basic technical analyses for the timing of buying and selling securities, but it will also offer many other features. It should also offer clients a wide range of charts, options for executing combined orders, as well as the use of trading through algorithms.

Options of trading platforms at LYNX broker:

- Trader workstation (TWS) – platform for demanding investors

- LYNX basic – a platform for easy investors

- Mobile trading apps for iOS and Android – the future of mobile trading

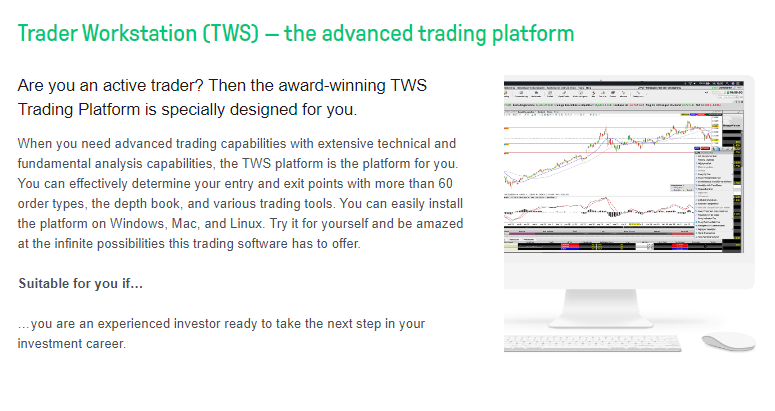

Trader workstation

The platform is suitable for active investors who want to take advantage of a wide range of products in one place. It can trade more than 60 orders and algorithms that can perfectly plan and execute market inputs and outputs in any market situation. It can also connect with other platforms and is supported by many operating systems.

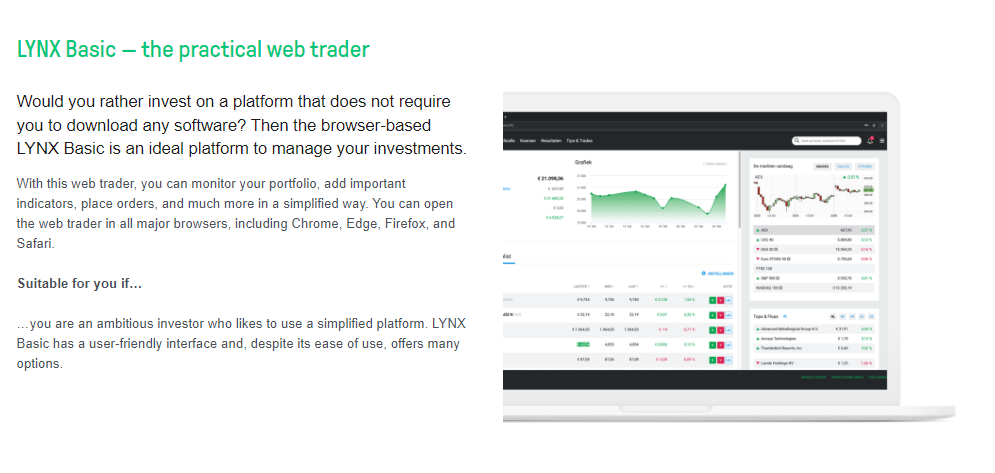

LYNX basic

This platform is suitable for ordinary investors. It is very simple and intuitive. You can place orders for your trades, check your account balances and read information about individual instruments and analyses. No installation is required for this platform. Equity and ETF investors will enjoy exactly what they expect from their trading.

Mobile business app for iOS and android

2022!! So I can’t imagine that this year it would offer such a professional company as LYNX an application for a smartphone or tablet. Fortunately, even here everything is in perfect order and clients can look forward to an application that will meet their wishes and needs. This application offers comparable functionality to the desktop trading platform. The app is suitable for iPhone, iPad and Android.

Fees and costs of investment

Fees with this broker are transparent. For clients who are starting out, however, they can be a little confused and complex. This is because the rates vary for different groups of instruments and also for individual world exchanges. Fees could be called high, for example, for forex, stocks or ETFs. The problem may be rather lower volumes of investments, because the company charges a fee for performance (usually around 100 CZK). Therefore, it pays to trade rather a larger volume.

| STOCK | FUTURES AND OPTIONS | STOCK CFDs | CFDS ON INDICES | |

| USA | 0,01 (MIN 5 USD) | $4 per contract | 0,01 (min 5 USD) | 0,05 (min 5 USD) |

| Něměcko | 0,12 % (min 6 EUR) | 3 EUR per contract | 0.10% (min 6 EUR) | 0,05 (min 6 EUR) |

| Czechia | x | x | 0,25% (min 140 CZK) | x |

| Great Britain | 0,10 % (min 10 GBP) | 4 GBT per contract | 0,10 % (min 6 GBP) | 0,05 % (min 6 GBP) |

Individual fees:

- The brokerage fee (commission, or tariff) is a one-time fee that the client pays for each purchase or sale.

- Spreads (the difference between the buy and sell prices) are market and the broker does not charge any mark-up here

- Currency conversion fee – a conversion fee is paid (for example – purchase of US shares on a CZK account)

- No deposit fee charged

- The withdrawal fee is free one month, but the others cost 300 CZK

- The inactivity fee is defined by the Company as follows: if the value of your account is less than $1000 and if the client does not pay at least $1 in fees during a calendar month, the Company charges this fee. Fortunately, it’s not big– it’s a maximum of $1 a month. I very much appreciate this, because some brokers make a lot of money on these fees.

- Fees for additional services are interest if the client borrows currency, or a fee for live data from the exchange

This list does not offer all the fees of the company. But I very much appreciate that all fees are transparent, visible and detectable in LYNX’s tariff. This is not the case with other brokers.

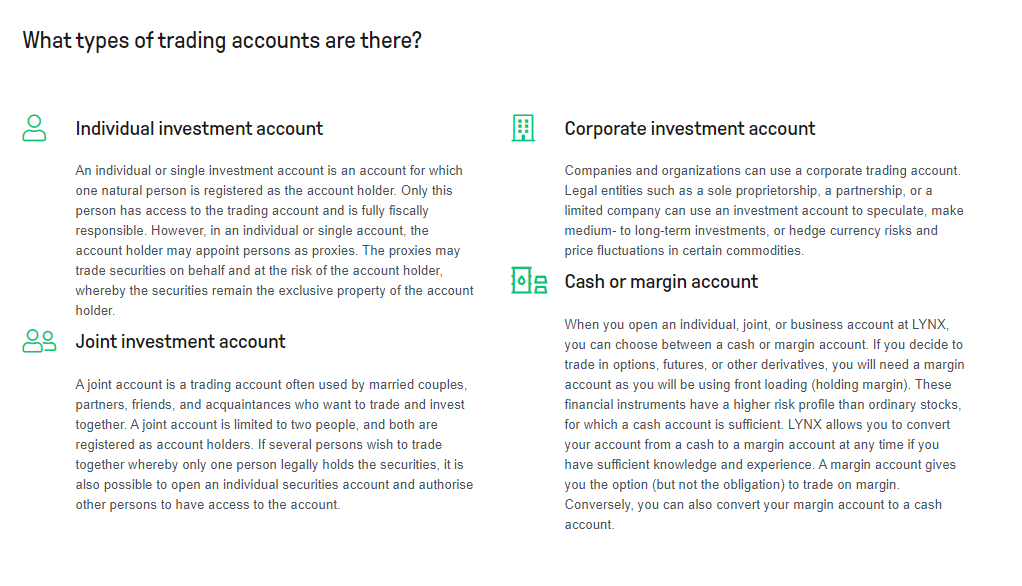

I would also like to mention the fees relating to registration, deposits and withdrawals. That being said, the LYNX broker offers 2 kinds of basic accounts. A cash account offers leverage-free trading, while a margin account allows leveraged trading. The condition is that the value of the account is constantly higher than 2,000 USD. Its advantage is the possibility of immediate withdrawal from the trading position.

Education

Of course, a company like LYNX is also a broker that is aware of how challenging trading can be for a beginner. But of course, even those who are no longer beginners need to further and further educate themselves in time so as not to get lost in the world of finance.

The Education and Inspiration tab is suitable for all types of investors. LYNX has created an investment portal where clients have access to all educational webinars, articles and newsletters from experienced investment professionals.

Newsletters are suitable for clients who are interested in what is happening on the stock exchange and are inspired by stock analyses with ETFs. Thanks to this, you will have an overview of all important events in the financial markets.

LYNX webinars will expand our knowledge of investing and trading from the comfort of your home. These webinars will be accompanied by experienced investors and traders who will discuss both the theoretical and practical parts with us. He will advise us on investment strategies as well as orientation in the Trader Workstation and LYNX Basic platforms. Thanks to this, we can find out how to successfully trade stocks, options and other financial instruments.

These webinars are saved to the webinar archive after each broadcast, which can also be found on youtube.

What I would like to mention is the fact that you can also ask the lecturers who create the webinars a question via chat. I consider this to be another advantage of LYNX – a specific question requires a specific answer.

Lynx Company website

Everyone might think that it is not important what the company’s website looks like, but the opposite is true. From a psychological point of view, this is a very essential part of society and many clients make their first impression. Whether the site is clear, interesting, simple.

I have to admit that the website www.lynxbroker.cz is, in a word, great. They have wonderfully matching colors that do not distract clients. Right at the beginning, I was very surprised by the changing picture, which very humorously captures the broker’s motto: “take your investing to the next level”. The picture shows how a small pony becomes a big horse and the jockey sitting on it is excited and pleasantly surprised. Funny and simple. At the same time, however, it does not distract from the important.

In virtually every part of the site it is possible to open a client account. So we don’t have to very laboriously over-the-top. The top bar offers us all the information we need. From the reasons why we should choose LYNX, to products or exchanges, trading platforms, fees, education, to client support.

Client support is an integral part of the company’s website and it takes great pride in it. The Support Center offers us:

- First steps for new clients

- About account management and settings

- Detailed explanations and tutorials for the trading platform

- Advanced trading order settings

- Types for using their web platform

- Tutorials for mobile trading app

- Advanced details of individual investment instruments

This is how we will find detailed answers to the most frequently asked questions.

In the lower right corner we can immediately start chatting with the company’s support, so we do not have to search for anything and we get an answer practically nonstop. So I have to say that the management of client support is really in the absolute TOP of the LYNX broker.

If necessary, we can contact the company at 800 877 877 or info@lynxbroker.cz.

Advantages and disadvantages of Lynx

Advantages:

- Wide range of investment products

- Many international trading exchanges

- Clear list of fees

- Multi-language support

- Support of Czech language and trade in CZK

- Professional trader and a big player in the investing market

- Very advanced client support

- Professional Trading Platforms

- Websites at the TOP level

- Enough information for all types of clients

Disadvantages:

- Minimum deposit 75 000 CZK

- Does not offer Czech shares

- Higher fees

- For clients who are starting out, the fees are very confusing at first

- Payments are only possible by bank transfer

Lynx Review Conclusion:

LYNX broker is definitely a professional in the investment market. Their website is a feast for the eyes and they definitely have very strong client support. Thanks to their trading platforms, both experienced brokers and complete beginners can trade with them. Despite the higher fees and high minimum deposit, I would say that LYNX can certainly be an interesting option for many, many investors. And those who are already well versed in investment trading? They will certainly appreciate the volume of tradable products, the diversity of world markets and also professional trading platforms.