The financial market is constantly on the move. InvestaGO has decided to take advantage of this dynamic and brings to the financial market an offer of trading with the most popular instruments. In an environment where something special is needed to impress, InvestaGO is trying to fill a gap in the market by offering an innovative approach and reliable client support. Let’s take a look at what all this company has to offer – our InvestaGO review summarizes the most important information.

Table of Contents – InvestaGo review

About InvestaGO

Regulated brokers must follow rules that protect investors and their funds. A key requirement is to maintain a minimum amount of capital in liquid form, which provides certainty in the event that a broker goes out of business or goes bankrupt. In addition, they are required to keep client funds in segregated accounts so that they are not used for other purposes. In some countries, such as the UK, clients are even provided with deposit insurance, which can help recover funds in the event of misappropriation.

Thats is why the choice of InvestaGO is a safe one. INVESTAGO is a licensed trading company of Wonderinterest Trading Ltd. This is a company based in Cyprus and has been a big player in the finance market for several years. The company is supervised and regulated by the Cyprus Securities and Exchange Commission (CySec) and its clients can continue in their investments safely.

The company can trade in securities and other financial market instruments. Of course, it can also provide its clients with share certificates. All of this information will be provided later on in this review.

What can you trade on InvestaGO

FOREX

When trading CFDs on Forex, it is crucial to understand what you are actually trading. The term “contract for difference”, or CFD, refers to an agreement between a buyer and seller where the difference between the current price of the underlying asset and its price at the time of the contract is exchanged. This is how it works in currency trading: instead of physically owning the currency, you trade CFD contracts that allow you to speculate on changes in its price. So you watch whether the price of the currency goes up or down, because the difference between your buy and sell price determines your profit.

COMMODITIES

CFD commodities are often referred to as risky investments because their prices are significantly affected by unpredictable events such as natural disasters or geopolitical conflicts. Nevertheless, they can be a valuable tool for diversifying an investment portfolio. Investors have various instruments, such as futures contracts or ETFs, which allow them to tailor their exposure to commodities to their individual preferences.

Learn more about ETFs: An introduction to ETFs

INDEXES

They allow us not to buy the underlying asset directly. We can also increase our buying power by using so-called “leverage” during trading hours. Leverage is offered by INVESTAGO 1:20. However, in some cases (e.g. for larger investments or VIP clients) the leverage can be increased to 1:100. As such, leverage can increase our profits in a matter of seconds, but beware… it can also quickly put us into a huge loss.

SHARES (CFD + Physical)

The most commonly traded is, of course, equities. CFD shares allow us to enter into the trade of individual companies with even the smallest share. Here, one classically trades on the rise or fall of the traded assets.

Physical shares give you a real stake in the ownership of the company, unlike CFD shares. By investing in shares you get the opportunity to influence the running of the company based on the size of your stake. The larger the shareholding you have, the more input you can have in decisions about its management.

Trading Style

INVESTAGO is no different from its competitors in the way it trades. And let’s face it, that’s actually a good thing. Clients jump into the world of INVESTAGO easily and without any mistakes in placing trading orders. This broker (as mentioned in the introduction) follows classic financial market regulations. Your finances are therefore protected from possible insolvency of the company.

To trade, of course, you need to open a client account, which we will get to later on

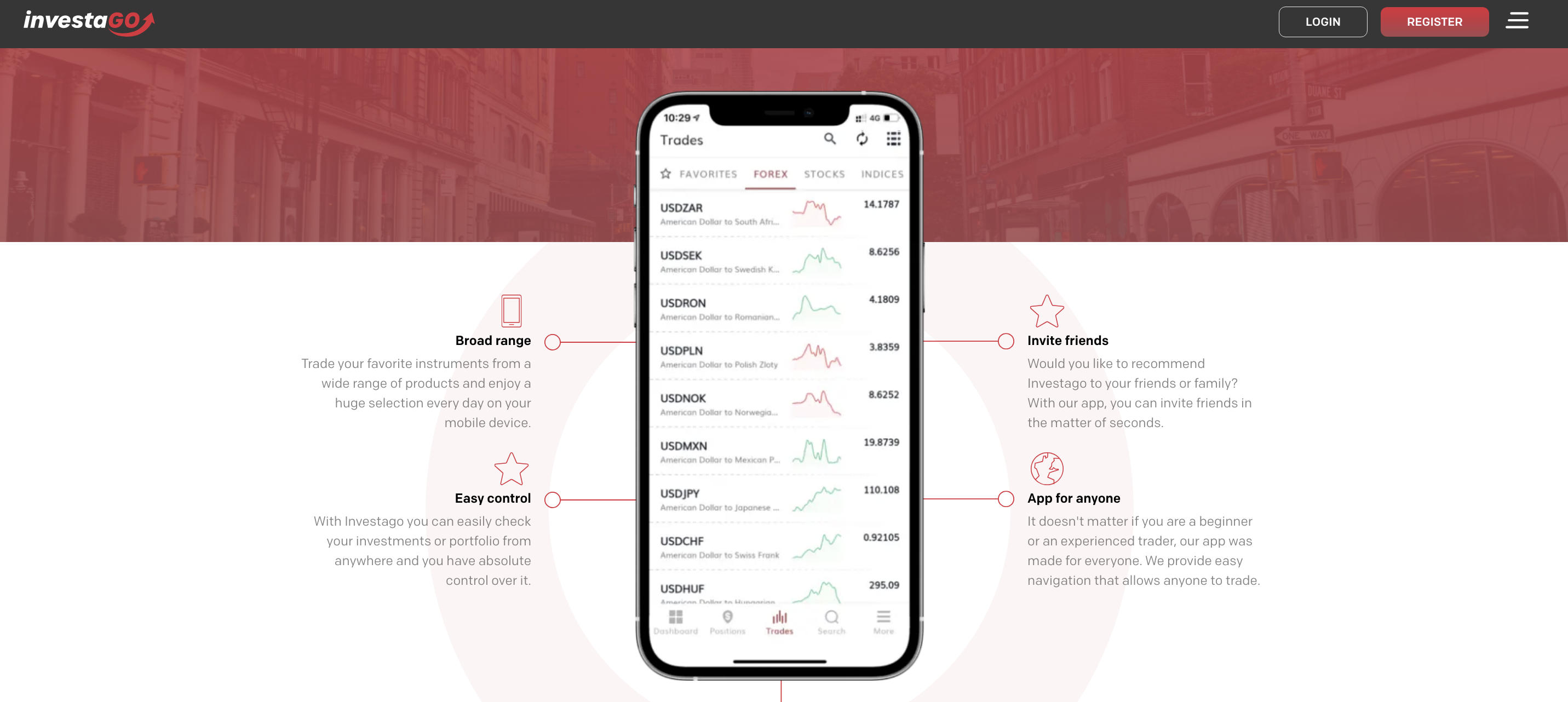

What is worth mentioning, however, is the company’s elaborate mobile app. Of course, the app can be downloaded both on the app store and on google play. So it should not happen that your mobile phone does not support the app. Thanks to the app, you can trade your favorite tools and products on an online level. Thus, you will not miss any business opportunity. The INVESTAGO app is very easy to use.

The platform is available not only in mobile, but also on a desktop app. Everything important, including the ways of installation, is listed in the xStation 5 folder.

Read more from us: What is FTMO?

Company website

The site of this broker is very simple and visually pleasing. The dominant colour is red, which is slightly complemented by black and white graphics. There are no moving pictures or stick figures to distract the investor.

The homepage gives us simple information – “Go Trading” and warns us about the risks involved in investing. Being aware that we are entering a world of hard business in which, although we can appreciate our investments many times over, we can also lose a significant part of our funds, is very important to notice.

In the top right corner we need to open the menu, where we select the section that interests us specifically. Everything is clear and simple.

The first folder is information about what is happening in the world of investments. Specifically, this is news from the financial markets. Information is added about once a week and it is mainly relevant news concerning big companies such as Adidas, Netflix or McDonalds, for example.

Another item is information on trading. Here you can find out what companies are offering, information about the mobile app and also everything about how trading is done.

There is complete info about the profile of the company as well, in which you can read about the regulations InvestaGO is subject to. Next, of course, are the company’s contacts and support. A phone number including email where you can contact the company with questions or any problems. In this section you will also find the full terms and conditions of the company. So virtually everything we need to know to decide whether to trust this company with our money is in one place. Absolutely simple and straightforward.

The website is available in 5 languages: English, Czech, Slovak, Spanish and Hungarian.

Demo and client account

As for the DEMO account. The good news is that INVESTAGO broker offers it. Not everyone is ready to jump right into the fray. And BEWARE, if we open a classic account and do not trade, we pay a fee for the so-called inactivity. The demo account is valid for 30 days at INVESTAGO.

It is very easy to open a client account with INVESTAGO with just a few clicks. You enter your details, of course.

- Name and surname

- Phone number

- + It is necessary to agree to the terms and conditions

Although, just because we have a client account doesn’t mean we can start trading. We need to comply with the company’s terms and conditions, which we agreed to when we registered the account. The company has to verify several facts such as age, nationality, residence and so on. Therefore, we need to provide documents, or rather, copies of them.

- passport (double page with photo, lines must be clearly visible)

- ID card, OP (both sides, again must be legible)

- Driving licence (both sides)

- the name and surname, date of birth and expiry date must be visible on these documents (the documents must be valid)

The company must also verify the client’s residence. It is not a rule that the address on the documents is the same as the address where the client actually lives. For this reason, financial companies require documents that show the real address. These can be, for example:

- Invoice for utilities (gas, electricity, water, garbage collection)

- Internet invoices

- Statement (bank or credit card)

- Rental agreement or lease account

- State residence certificate

- Mortgage

- Official letter (police, embassy, lunch office)

At INVESTAGO, it is also possible to trade as a company. Here, however, you also need to register as a company. Here too, there are conditions that clients must meet in order to conclude their financial transaction through this broker.

- Company registration number

- Registered company name and business name (these 2 things may differ)

- Registered office and place of business (they may also differ)

- Managing directors, members of the board of directors, or natural persons authorised to act for the company

- The company’s decision on who will handle the client account with INVESTAGO

- The company’s decision to open the account

- List of ultimate owners

- List of registered owners

- in the case of companies, it is necessary to provide originals or, if necessary, notarized copies.

Investago TV, Investago Quiz

INVESTAGO follows a very progressive path. Not only is it fully aware of how essential it is for the company itself to follow trends in the financial sphere, but it is also aware that in order for its clients to be successful in their transactions and for investing to bring them profits, it is they who must be educated.

Many brokers nowadays have already filmed various tutorials explaining what futures and CFD contracts are. Or they show how to navigate their applications with videos. However, I have yet to come across a broker who has created a direct channel for their clients to follow everything relevant that is happening in the world of investments and finance at any time.

Investago TV

Directly in the GO Watch tab, we can find clear videos that inform about current events on the global markets. This is not an explanation of terms or an educational module. These are classic news items, but they focus on messages that may move the market in some way and thus affect investments you already own, or point out that a certain situation could help you to buy an investment.

Videos are uploaded on an approximately weekly basis and we always include information next to the video as to what it relates to.

Academy

Like other brokers, INVESTAGO has recorded tutorials that give us basic information about the products and how investing works in practice. However, the quality of the video and the necessary information is not always matched with practice.

However, INVESTAGO has managed this to a tee. Not only does it have very well produced tutorials that give a head and heel… but even those who are not too fond of video and prefer to read the essential information will find it useful. On the right side we find everything listed and on the left the tutorial. Clear, simple and all in one place.

The information covers not only the products we can trade, but also the exchanges they are on, the platform they use and news from the world of trading.

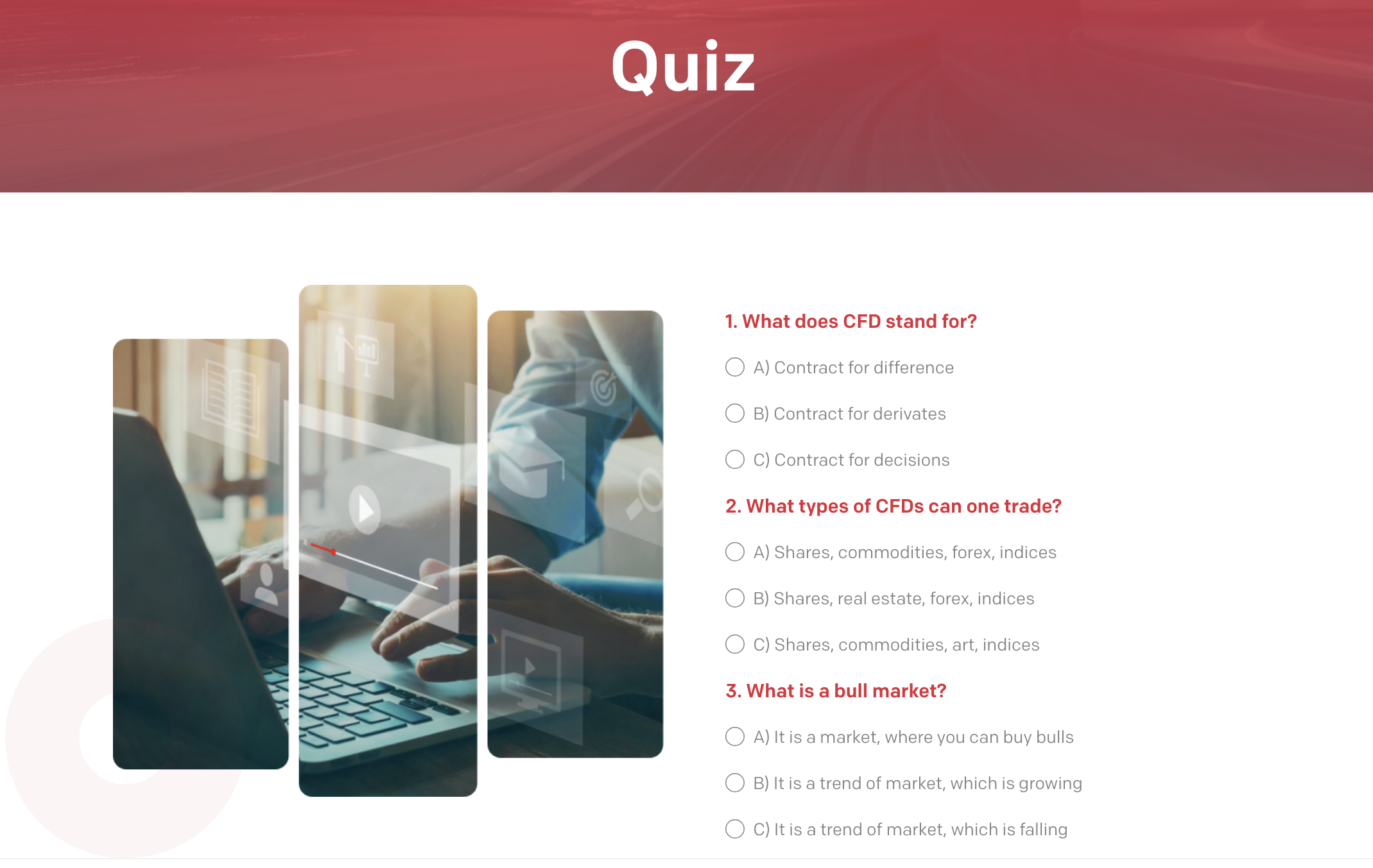

Investago quiz

Ideas about what is enough to invest for individuals may vary. Some investors just want to invest small, tiny amounts and try to see how the market works. You also very often see the type of investor who has a certain amount of money that they are willing to lose and they like to take risks. After all, “risk is profit”. Another type of investor are those who really need a lot of information to risk their money. So they will definitely make use of tutorials as well as INVESTAGO TV and a lot of information that can be found and freely available on the web.

Alternatively, they also read reviews of companies and make their decisions accordingly. Who they invest with, what they invest in and how much they are willing to invest. And we must not forget those who are really investing large sums of money, even in the order of several hundred thousand EUR or USD, or even millions. Here we need to know the market and all the possibilities that the markets offer us very well.

And this is what the quiz that INVESTAGO broker has prepared for you will help absolutely every type of investor. You simply answer 10 questions and have your performance evaluated.

The company will then evaluate your knowledge based on the number of points you have earned.

- Lack of points – the company will warn you that you need more education in finance and direct you to the education section (tutorials, etc.)

- Average score – the company will assess that your results are good but you could do with more education. In this case, it will direct you to the DEMO version, where you can try everything out within 30 days and gain the confidence needed for live trading.

- High scores – the broker will assess that your knowledge is at a very high level and will immediately offer you the opportunity to open a client account and encourage you to “start trading”

Summary of InvestaGO

InvestaGO is in fact no newcomer. It is backed by a large Cypriot investment company that has been a big player in the market for several years. This broker really clings a lot to the safety of its clients’ funds.

It can trade forex, commodities, stocks and indices and it can trade on a large number of world exchanges. It uses a very well-functioning mobile app for its trading, so you are in touch with your funds at any time and will not miss any important trades. Whether it is a sale or a purchase.

However, what INVESTAGO really emphasizes is education. You will simply find the company’s terms and conditions, all the documents you will need to activate your client account, whether you are an individual or a business (i.e. you will be investing funds owned by a company). You can also find tutorials that will give you all the product information. But also tutorials that pull you into the app and walk you through the exchanges.

A bonus that the broker INVESTAGO owns is of course Investago TV, which regularly inserts programs about current topics in the financial markets in the world, but especially INVESTAGO Quiz! It is truly unique and draws the attention of potential investors to the opportunity to supplement their knowledge before they really get into the world of investments, where knowledge is unfortunately unforgiving and clients can pay for it by losing their funds.

Conclusion – InvestaGo review

The progressiveness of this company is good to see. You can notice that it is looking to the future with a definite eye on short-term profit. It is trying to retain its clients, show them the right path and guide them as easily as possible through the world of finance and investments to a clean profit.

In our opinion, it is worth visiting www.investago.com and giving this broker a few minutes of your time. You may be pleasantly surprised, as we were.

stated communicating with a man claiming to come from the United states online around 6 months ago and everything was going well till he started demanding for money from me . I was forced to send over $280,000 to him, i sent this in batches and when i was almost going broke i told him i am not sending to him again . He became abusive for some days and he deleted my contacts, i was so devastated and i was really disappointed that i could be scammed but it could have happened to anyone so I had to find a way to get back and bounce back my feet I search for a way and contacted a recovery firm via gmail ( mikaellindberg124@gmail.com ) am happy that i was able to recover more than $410,000 I will recommend the recovery firm to anyone with similar issues

After being in depression for so long trying to recover my lost funds to IQ option scam, I searched on different forums to read other victims stories and luckily one day i read a story about Johnson Oliver the read on how some victims got their money back.This recovery expert out there legit and not all these fake recovery company lying just to scam people the more. I contacted him on his personal Gmail {wilsalson71@gmail..com} And i surprised by his timely response and the way he handle the recovery process after providing evidence to back up my claim. long story short. i got my $40400 back from Tor options. To everyone out there, this is real.. Give him a try