A simple guide for crypto enthusiasts who seek a reliable exchange with the lowest fees

The market is saturated with cryptocurrency exchanges, and so it’s easy to get lost among all the different players and their various services. Moreover, there are many online tools that compare exchanges and countless review websites available.

To help you get your bearings quickly and reliably, we offer you a direct and relatively easy way to make your own assessment and decision on which cryptocurrency exchange to choose for buying and selling cryptocurrencies.

We have selected five major exchanges whose range of services and experience shall satisfy the general needs of crypto traders and investors. We’ve examined what they do to meet the essential security requirements, which is considered as the alpha and omega of any sensible trader.

We have then focused on the comparison of their crypto trading fees.

Crypto Exchange Fee Ranking

Our research was based on grouping traders/investors into three categories, according to their trading volume and have then found typical trading fees for a maker and a taker kind of order.*

Besides security and fees, there were other criteria which have been examined, including user-friendliness, customer support and available payment methods.

Our selection includes Binance, BITmarkets, Bybit, Coinbase and Kraken. Below, you can find the results of our fee comparison (as of January 16, 2024) as well as a summary of the exchanges’ pros and cons in other areas.

Binance

Binance is regarded as the world’s most renowned crypto exchange with competitive products. The United States-based exchange offers multiple services, charges low trading fees on crypto-to-crypto trades for small retail traders and hosts a platform which supports the trading of a wide selection of cryptocurrencies.

However, Binance users have complained about the long & complex login process – highlighting its low-user-friendliness – and the exchange is currently facing a serious criminal and regulatory allegation. On November 21 of 2023, Binance pleaded guilty to money laundering charges, agreeing to pay $4.4 billion in fines to settle the charges.

Pros & Cons

Pros

- Large selection of tradable cryptocurrencies

- Low trading fees on crypto-to-crypto trades for small retail customers

- Offers multiple products and services

Cons

- Major regulatory concerns

- Complex trading platform

BITmarkets

Based in the EU (Lithuania), BITmarkets is a fresh & ambitious cryptocurrency exchange that has grown rapidly in the past year. The exchange aims to simplify the crypto trading process by focusing heavily on user-friendliness and accessibility.

BITmarkets fees are ultra-low, and the exchange hosts a simple yet intuitive crypto trading platform. BITmarkets also provides localized 24/7 support in more than 15 languages and offers heaps of services for its users, including a deposit-to-margin feature, a wide range of educational material and daily market updates.

While BITmarkets boasts many pros, it’s regarded as a relatively young player in the crypto industry, since it only began operating in early 2022.

Pros & Cons

Pros

- Simple & intuitive trading platform

- Localized support in 15+ languages

- Low fees for all types of investors

Cons

- Unseasoned player in the industry

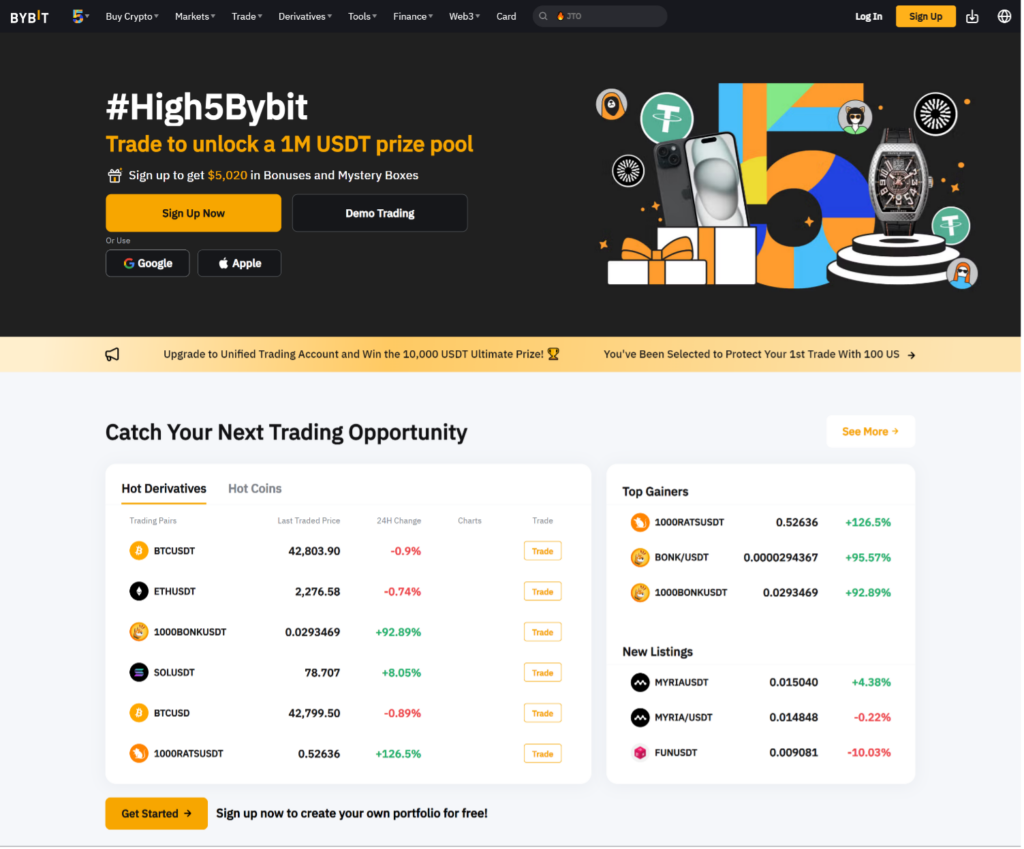

Bybit

Bybit is a popular cryptocurrency and derivatives exchange headquartered in the UAE. The international reach of Bybit is impressive and provides intuitive tools for cryptocurrency trading as well as extensive educational resources for its users.

While Bybit charges low crypto trading fees, the cryptocurrency exchange does not provide a user-friendly interface for spot trading and the cryptocurrencies available to trade on the platform are limited.

Pros & Cons

Pros

- High international reach

- Advanced crypto trading tools

- Low trading fees

Cons

- Limited range of tradable cryptocurrencies

- Less-positive user feedback

Coinbase

Regarded as the largest cryptocurrency exchange in the United States, Coinbase hosts a user-friendly crypto trading platform which supports the buying & selling of more than 200 cryptocurrencies.

Coinbase users have praised the exchange for its rapid crypto withdrawals and it’s known for its native NFT marketplace and its easy user interface for cryptocurrency trading.

However, trading cryptocurrencies with Coinbase incurs high fees, the exchange is infamous for its major legal issues and Coinbase users have complained about the poor customer service provided by the exchange. In June of 2023, Coinbase has been accused by the United States Securities and Exchange Commission (SEC) for allegedly operating as an unregistered securities exchange, hampering its reputation.

Pros & Cons

Pros

- More than 200 tradable cryptocurrencies

- Low minimum deposit requirement

- Rapid crypto withdrawals

Cons

- High crypto trading fees

- Regulatory issues

- Poor customer service

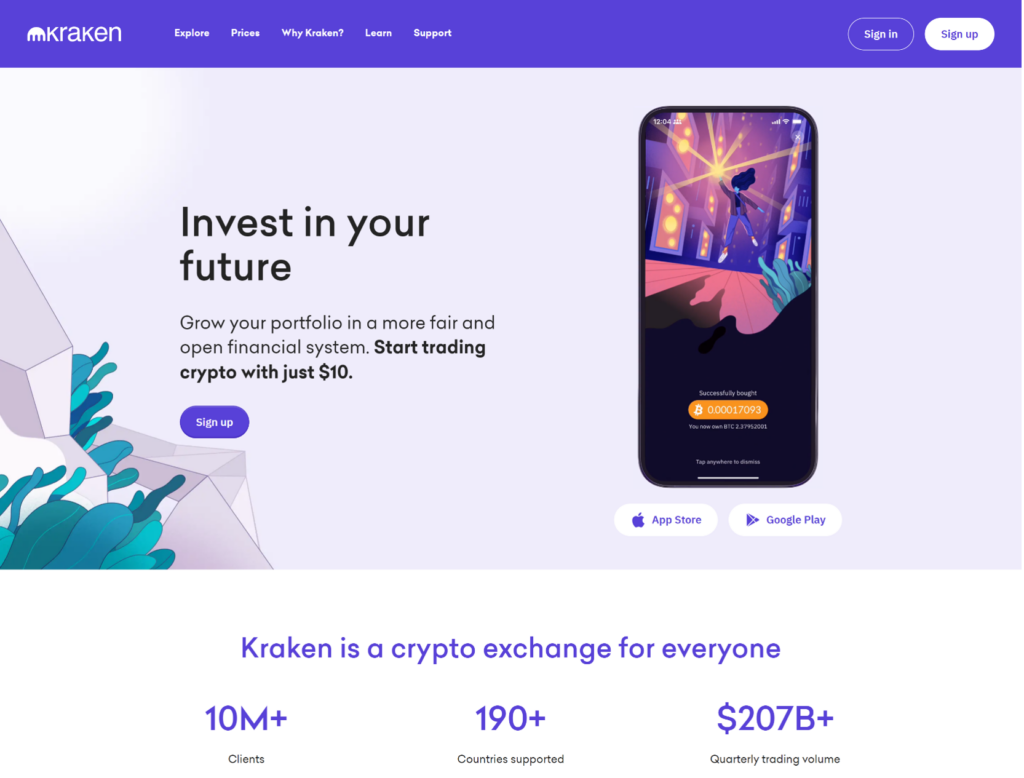

Kraken

Kraken is among the most seasoned cryptocurrency exchanges in the industry. The cryptocurrency exchange hosts a platform better suited for advanced cryptocurrency traders and investors since it offers advanced tools and features. Kraken also provides users with a free trial option for futures trading without using real money.

While Kraken supports more than 200 tradable cryptocurrencies on its platform, the exchange only accepts a limited number of fiat currencies to fund accounts and charges relatively high fees when trading with the USD.

Pros & Cons

Pros

- Innovative trading tools for advanced users

- Large selection of tradable cryptocurrencies

- Lower fees for advanced traders.

Cons

- Limited options for funding accounts

- High trading fees when using USD

* Makers create buy or sell orders at a specified price limit, which are not immediately executed, thus adding liquidity to the market. This allows others to quickly execute buy or sell transactions when the price meets these set limits. Takers, in contrast, buy or sell immediately at the current market price, removing liquidity from the market.